The global equity markets especially in the Far East have been in risk-off mode, following the cut by Apple Inc. to their revenue outlook. The move is said to be partly responsible for triggering a wave of risk aversion in foreign exchange markets, prompting heavy selling of the Australian dollar and Turkish lira against the yen, which in thin liquidity conditions delivered wild swings in currency markets overnight.

While the euro is not a safe haven, so as a result it rightly suffers against USD and JPY in times of risk-off but is standing up quite well compared with most other G10 currencies.

Well, there have been many admired FX options trading strategies among FX investors, such as, the carry trade or long-short momentum trades that fetches luring yields during “risk on” “risk off scenarios.

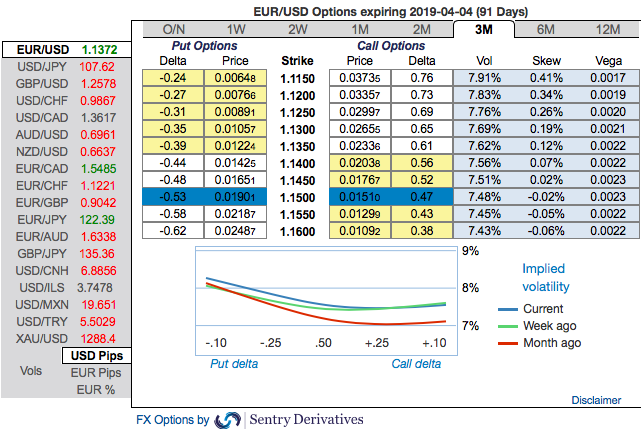

FX Derivatives Strategy (EURUSD): Options Strips

Combination ratio: (2:1), spot reference: 1.1384

Rationale: You could easily make out that EURUSD skews have been signalling downside risks in 3m tenors that signifies hedgers interest in the OTM put options.

To substantiate these indications, the RRs for negative bids in the 3m coupled with the above-stated risk off sentiments indicate the directional trading strategies.

Contemplating the prevailing bearish technical environment (in long-term) and most importantly, the positively skewed IVs in the sensitivity tool indicate hedging sentiments for the bearish risks, these risks are coupled with the bearish risk reversal numbers.

The execution: Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, go long 1m at the money +0.51 delta call option simultaneously.

The strategy can be executed at net debit with a view to arresting FX risks on both sides and likely to derive exponential returns but with more potential on the downside.

Alternatively, shorting futures of mid-month tenors are advocated with a view of arresting further potential slumps. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: sentrix, saxobank

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -31 levels (which is mildly bearish), while hourly USD spot index was at 37 (mildly bullish) while articulating (at 10:01 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data