- EUR/USD shown a massive profit booking after hitting fresh year high of 1.17761 yesterday after dovish Fed. The pair declined till 1.16500 at the time of writing. It is currently trading around 1.17123.

- Market awaits U.S GDP data for further direction. Any better than expected U.S GDP data will increase the chance of rate hike by Fed in this year

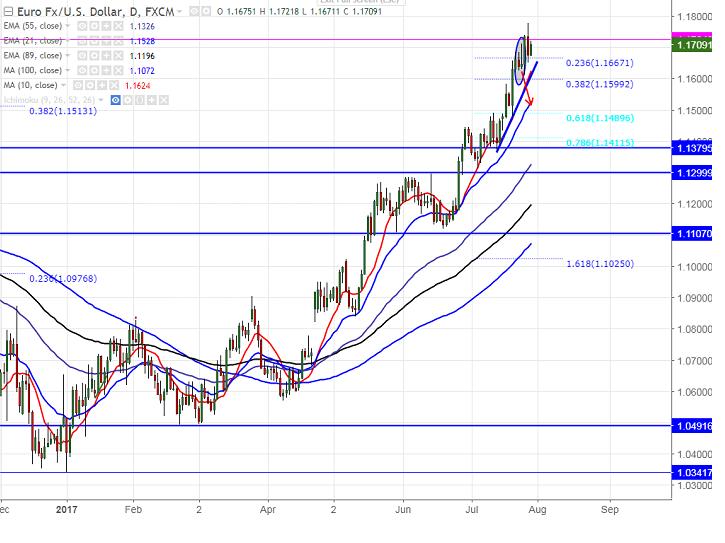

- The pair has temporary top at 1.17767 and potential reversal Zone is around 1.17767. Any break above will take the pair till 1.18000/1.1845.

- On the lower side, minor support is around 1.1643 (7- day MA) and any break below will drag the pair down till 1.1600 (10 – day MA)/1.14896 (61.8% retracement of 1.13123 and 1.17767).

It is good to buy on dips around 1.0660-65 with SL around 1.1600 for the TP of 1.1800/1.1845.