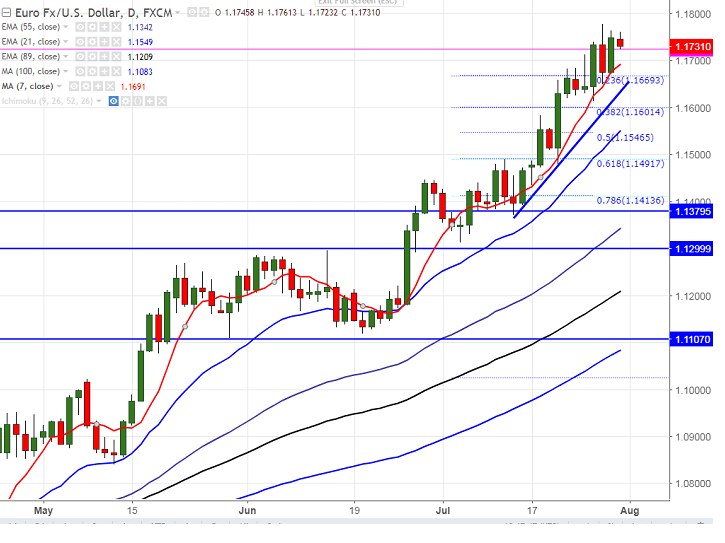

- EUR/USD has formed a minor bottom around 1.16500 on Jul 27th 2017 low and recovered from that level. The pair jumped till 1.17640 yesterday. It is currently trading around 1.17310.

- Market awaits major US economic data this week for further direction. U.S Nonfarm payroll data which is to be released on Friday is major economic event this week.

- The pair has temporary top at 1.17767 and potential reversal Zone is around 1.17767. Any break above will take the pair till 1.18000/1.1845.

- On the lower side, minor support is around 1.1628 (10- day MA) and any break below will drag the pair down till 1.1600 (38.2% retracement of 1.13123 and )/1.14896 (61.8% retracement of 1.13123 and 1.17767).

It is good to buy on dips around 1.16800 with SL around 1.1620 for the TP of 1.17800/1.1845.