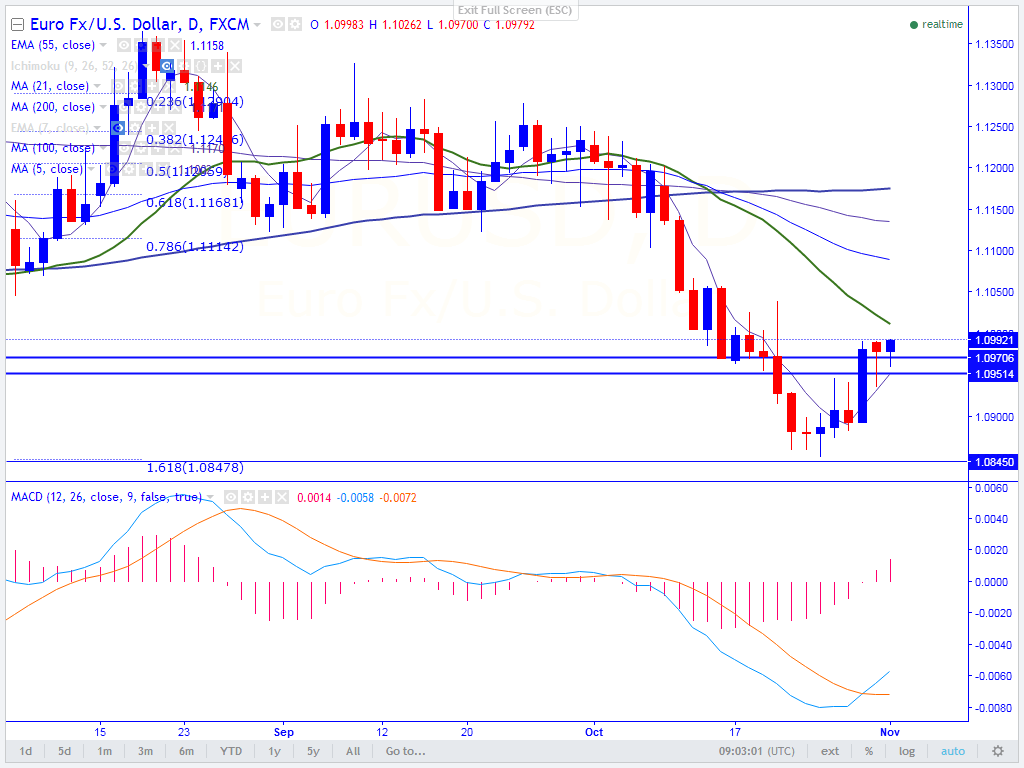

- Major resistance -1.10000

- Major support- 1.0930 (5- day MA)

- The pair recovered sharply after making a low of 1.0930. It is currently trading around 1.09904.

- Short term trend is slightly bullish as long as support 1.0930 (5- day MA) holds.

- Any break above 1.1022 (21- day MA) will take the pair to next level till 1.10650 (daily Kijun-Sen)/1.11000/1.1140 (100- day MA).

- Short term trend reversal can happen only if it closes above 1.11730 (200- day MA).

- On the lower side, any violation below 5- day MA will drag the pair down till 1.08500/1.08200.

It is good to buy on dips around 1.0970 with SL around 1.0930 for the TP of 1.1020/1.1065