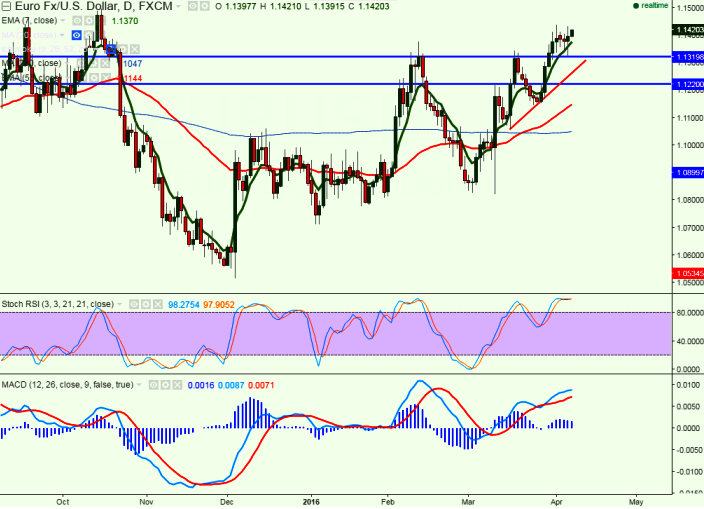

- Major resistance – 1.14380

- Major support - 1.1320 (55 day 4H EMA)

- The pair has recovered from the low of 1.13266 after dovish FOMC minutes .EUR/USD jumped till 1.14319 and closed near to 1.1400 level.

- US Mar FOMC Minutes confirms that Fed funds rate will be steady in the near term with further tightening likely to be delayed until 2016 end.

- The pair’s major resistance is around 1.14380 and nay break above confirms minor trend reversal, a jump till 1.1500/1.1545 is possible .

- On the lower side minor support is around 1.1380 and break below targets 1.1320/1.1280/1.1250.

- Minor trend reversal only below 1.1320.

It is good to buy at dips around 1.1390-95 with SL around 1.1320 for the TP of 1.1500/1.1545