Euro has been gaining on the back of all adverse news to dollar, that was the time when we advised vega spreads to tackle upside risks. Now our vega spread strategy has been taking care of current upswings.

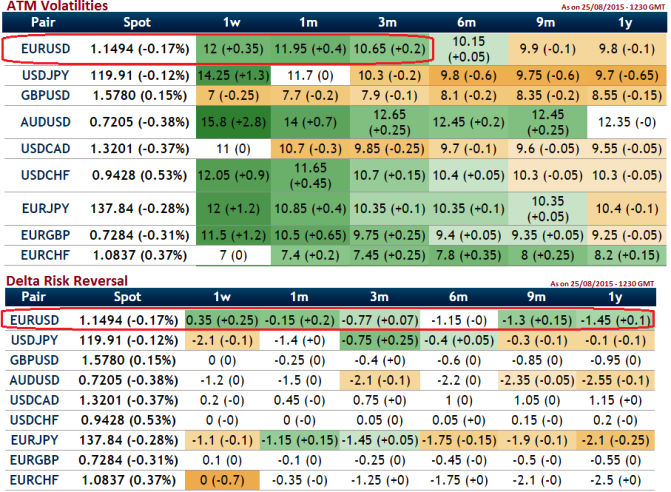

Rationale: But for now, from nutshell showing ATM volatility and delta risk reversal, it divulges that the fact that pair would experience little downside pressure in next I month future. The higher side volatility of EURUSD ATM contracts for next 3 months is projected. Although trend is puzzling on either sides the bearish momentum is likely to hold on. Huge volatility is expected over next 2-3 months.

How to execute: The spot EURUSD is flashing at 1.1033 and we think the prices will make a significant move most likely in a downward direction. At the money 7D calls (strike 1.1502) are trading at US$ 914.70 and it is recommended buying 1 lot (size 100,000). At the money 15D puts (strike 1.1502) are trading at US$ 1263.19 lots (same size 100,000 of each lot) are recommended. So thereby we've constructed option strip position at a cost of US$ 3441.08.

How does it work: If EURUSD exchange rate at expiry would still remain at around 1.1500 levels, then the options in both legs would expire worthless and this strategy goes in vein. But on the flip side, if the pair trading at 1.1470 which is the near term support by the time of expiration, then our at the money calls will be in the money and worth more premiums while the puts will expire worthless. The value of the calls will partially offset the initial investment for a total loss. If the pair trades at expiration slightly higher than that level, then the calls will be worth even more while the puts expire worthless. The value of the calls would be greater than the initial investment and our strategy will have made profits overall.

If the pair is trading below prevailing exchange rate (1.1500) by the time of expiration, then the calls will expire worthless while the puts will be worth more. The value of the puts will offset the initial investment and you will break even. By the time of expiration if the pair is trading 1.0966 levels which is our strong support levels, then the calls will expire worthless while the puts will be in the money and worth more. The premiums of the puts would be greater than the initial investment and the strategy will have made net profit overall.

FxWirePro: EUR/USD vega spreads job done – option strips well placed as hedging material

Wednesday, August 26, 2015 7:42 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: GBP/NZD downtrend loses steam but outlook still bearish

FxWirePro: GBP/NZD downtrend loses steam but outlook still bearish  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  FxWirePro:EUR/AUD upside limited, scope for a dve through a key fibo

FxWirePro:EUR/AUD upside limited, scope for a dve through a key fibo  FxWirePro: USD/ZAR edges higher but bearish outlook persists

FxWirePro: USD/ZAR edges higher but bearish outlook persists  ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000

ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000  FxWirePro: GBP/AUD key support held, downside risk remains

FxWirePro: GBP/AUD key support held, downside risk remains  Iran Tensions? No Problem! NZDJPY Surges Above Key EMAs with Bullish Momentum

Iran Tensions? No Problem! NZDJPY Surges Above Key EMAs with Bullish Momentum  FxWirePro:EUR/AUD neutral in the near-term, scope for downward resumption

FxWirePro:EUR/AUD neutral in the near-term, scope for downward resumption  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  AUDJPY Reclaims 111 Handle: Bulls Eye 112 Target After Dip

AUDJPY Reclaims 111 Handle: Bulls Eye 112 Target After Dip  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro: GBP/USD slides as UK political uncertainty weighs on pound

FxWirePro: GBP/USD slides as UK political uncertainty weighs on pound  FxWirePro: GBP/USD tumbles below 1.3400, might break another key floor

FxWirePro: GBP/USD tumbles below 1.3400, might break another key floor  NZDJPY Retraces on Tokyo CPI: Bulls Eye 95.00 Target as Support Holds

NZDJPY Retraces on Tokyo CPI: Bulls Eye 95.00 Target as Support Holds  FxWirePro: USD/JPY dips as yen gains after Tokyo CPI data

FxWirePro: USD/JPY dips as yen gains after Tokyo CPI data  FxWirePro: USD/CAD changes short term trend from neutral to bearish

FxWirePro: USD/CAD changes short term trend from neutral to bearish