EURGBP showed a minor pullback on the weak Pound sterling. It hits a multi-year low on weak Pound sterling. Intraday bias remains bearish as long as resistance 0.8365 holds. It hit a high of 0.83733 at the time of writing and is currently trading around 0.83625.

Last week, the euro (EUR) rose against the British pound (GBP), indicating increased demand for the euro. This change is due to positive economic data from the Eurozone and concerns about the UK's economic outlook. Investors are becoming more confident in the euro as they compare potential interest rate decisions from the European Central Bank (ECB) and the Bank of England (BoE). The ECB is taking a tougher stance on inflation while the BoE is being more cautious, affecting how the currencies move. Overall, the euro's gain shows changing market dynamics influenced by economic data and central bank actions.

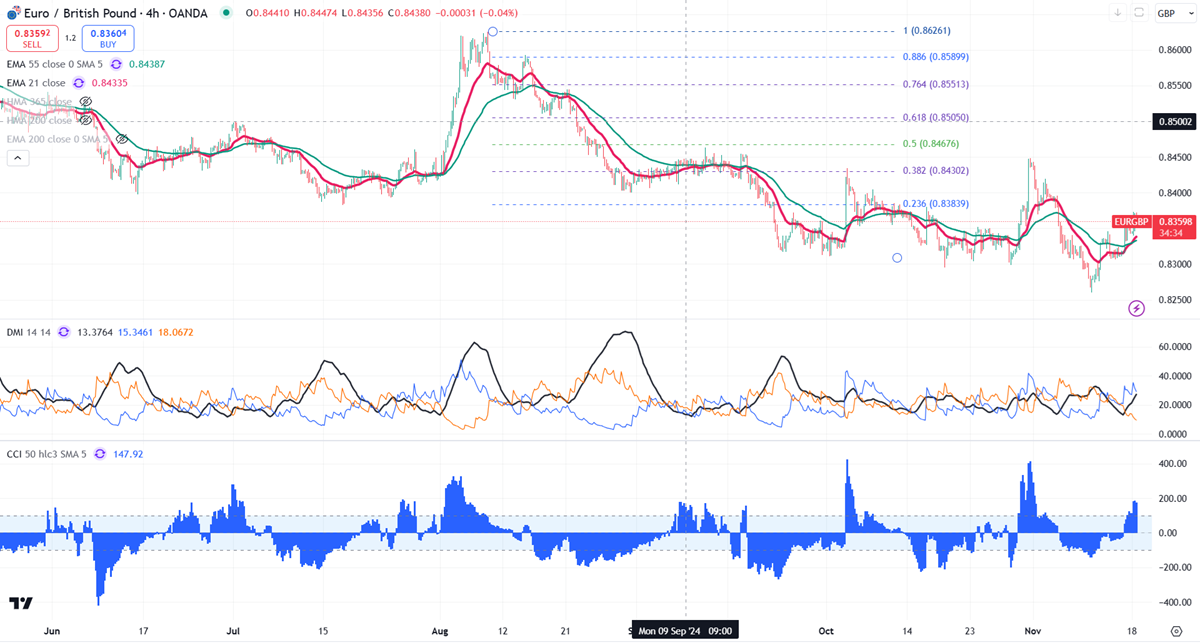

Technical Analysis

The pair is currently trading below the 34- and 55-EMA on the 4-hour chart.

- Bearish Trend Confirmation: If the price stays below 0.8260, it will confirm an intraday bearish trend. A drop to 0.8235 or 0.8200 is likely.

- Near-Term Resistance: Current resistance is around 0.8380. If it breaks above, we could see movement toward 0.83350/0.0.8380/0.845. The bearish outlook would be invalidated only if the price goes above 0.8500.

Indicator Analysis (4-hour chart)

- CCI (50): Bearish

- Average Directional Movement Index: bearish

Trading Recommendation

It may be wise to sell on rallies around 0.8378-80, with a stop loss set at 0.8365 and a target price of 0.8235.