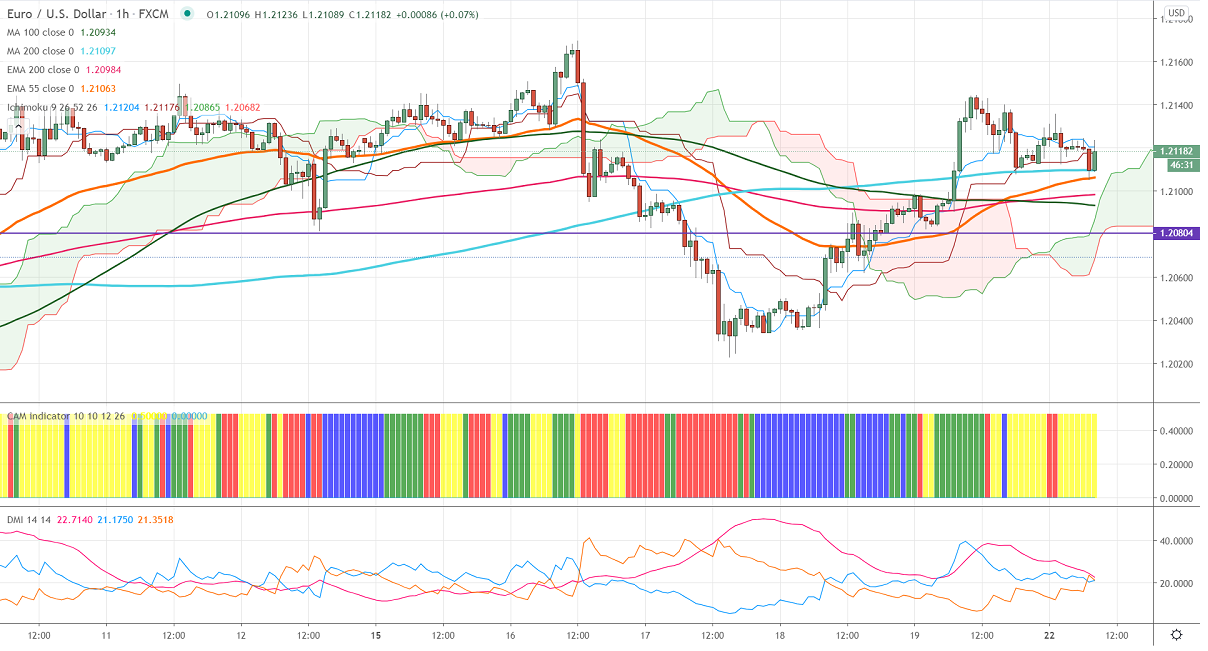

Ichimoku analysis (60 min chart)

Tenken-Sen- 1.21204

Kijun-Sen- 1.20790

EURUSD has lost more than 30 pips after a minor jump till 1.2414 on surging US bond yield. US yield jumped sharply and hits fresh 12-month high on more stimulus hopes which will increase inflation. DXY has formed a double bottom around 90.10 level, significant weakness only below 90. EURUSD hits an intraday low of 1.21053 and is currently trading around 1.21177.

Technical:

The pair is facing strong support at 1.2090. Any break below confirms minor bearishness, a jump till 1.2060/1.2020 likely. The near-term resistance is around 1.2180. Breach below will drag the pair up till 1.2200/1.2260.

Indicator (60 min chart)

CAM indicator – neutral

Directional movement index – neutral

It is good to sell on rallies around 1.2105-60 with SL around 1.2170 for the TP of 1.2000.