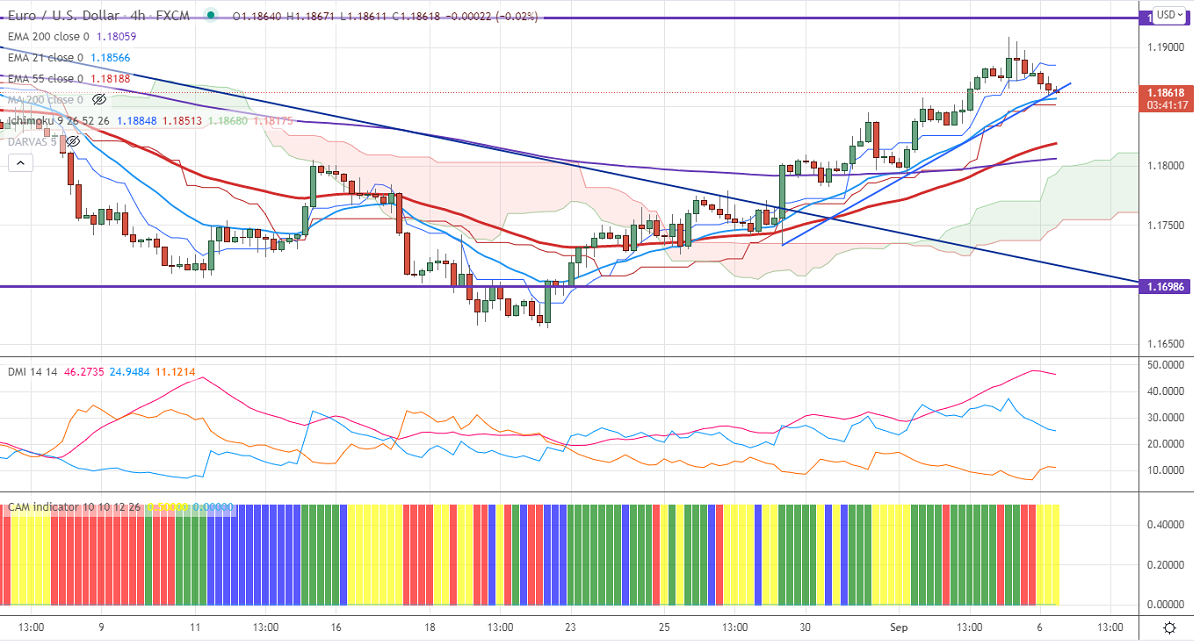

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 1.18867

Kijun-Sen- 1.18513

EURUSD surged sharply till 1.19090 after US jobs data. It came at 235000 jobs in August compared to an estimate of 720000. The pair has pared some of its gains made on Friday. Investors await for European Central Bank policy meeting on Thursday for further direction. The US 10-year yield regained more than 5% after hitting a low of 1.267%. EURUSD hits an intraday low of 1.18605 and is currently trading around 1.18660.

Technical:

On the higher side, near-term resistance is around 1.1920 and any convincing breach above will take to the next level 1.1965/1.2000. The pair's near-term support is at 1.1850, break below targets 1.1800/1.1780/1.1750.

Indicator (4-hour chart)

CAM indicator-Bullish

Directional movement index – Bullish

It is good to buy on dips around 1.18525-550 with SL around 1.1800 for the TP of 1.2000.