EURUSD showed a recovery of more than 150 pips after less hawkish comments from the Fed chairman. He said that Fed could slow the pace of rate hikes in December and it has a "long way to go" in bringing inflation down. It hits an intraday high of 1.04638 and is currently trading around 1.04338.

US private sector employment has added 127000 in Nov compared to a forecast of 196K. Markets eye the US Core PCE index and US ISM manufacturing index for further direction.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Dec dropped to 21.8% from 33.7% a day ago.

The US 10-year yield lost more than 5% after less hawkish Fed chairman comments. The US 10 and 2-year spread narrowed to -72 basis points from -80 bpbs.

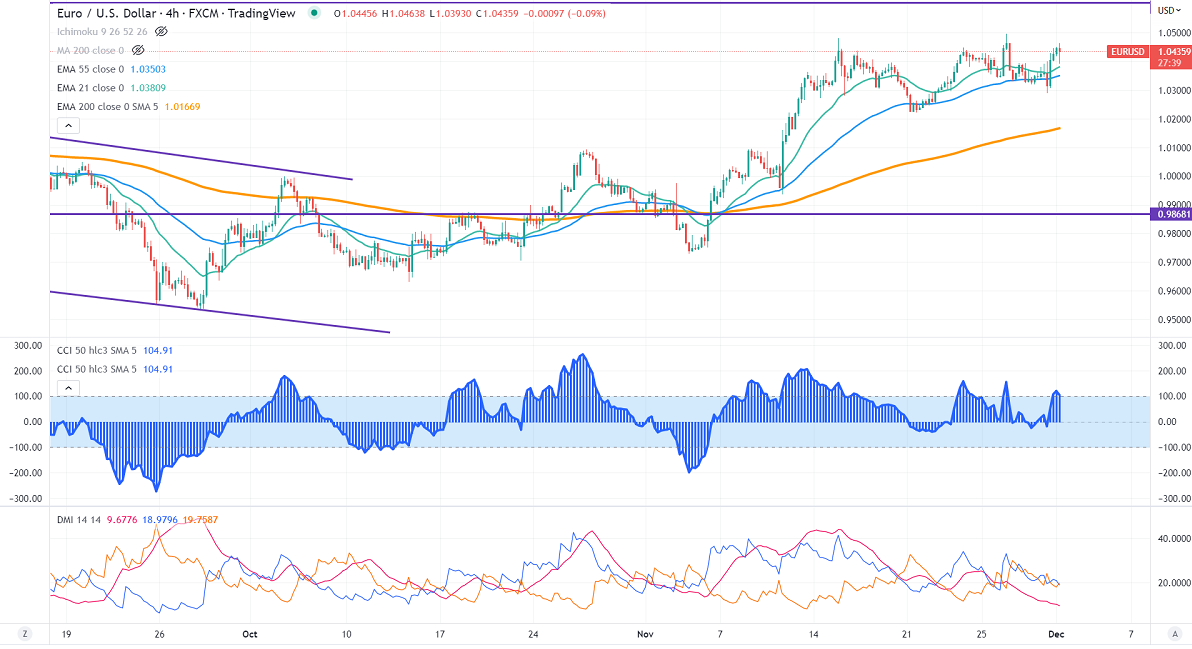

Technical:

On the higher side, near-term resistance is around 1.0500 and any convincing breach above will take the pair to the next level of 1.0550/1.0660.

The pair's immediate support is at 1.0390, breaking below targets of 1.0300/.02200.

Indicator (4-hour chart)

Directional movement index – Bullish

It is good to buy on dips around 1.03900 with SL around 1.0300 for a TP of 1.0600.