EURUSD pared some of its gains after the hawkish Fed rate hike. The central bank increased 50 bpbs at 4.25% -4.5%, the fourth consecutive increase. The dot plot shows the median rate at end of 2023 at 5.1% vs 4.6% at the September meeting. It hits an intraday low of 1.06056 and is currently trading around 1.06230.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in Feb 2023 rose to 73% from 43.90% a week ago.

The US 10-year yield showed a minor pullback from a minor bottom of 3.40%. The US 10 and 2-year spread widened to -75 basis points from -63.5% bpbs.

Technical:

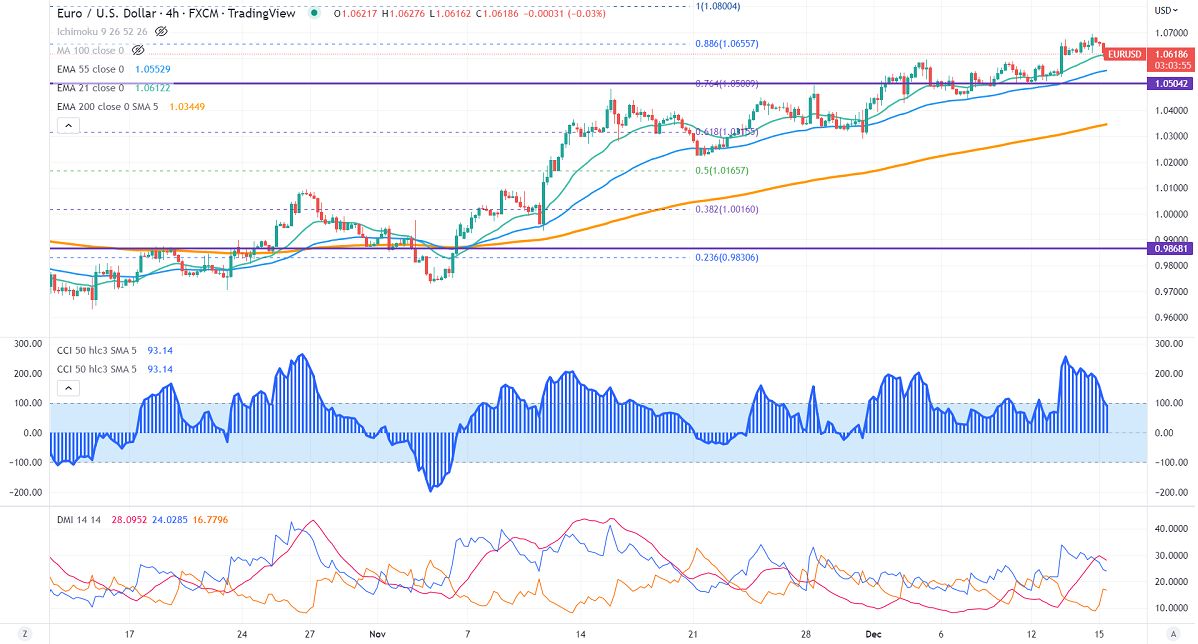

On the higher side, near-term resistance is around 1.0660 and any convincing breach above will take the pair to the next level of 1.0700/ 1.0750/1.0800.

The pair's immediate support is at 1.0570, breaking below targets of 1.0500/1.0430/1.0370/1.02900.

Indicator (4-hour chart)

Directional movement index – Bullish

CCI(50)- Bullish

It is good to buy on dips around 1.0600 with SL around 1.0560 for a TP of 1.0750.