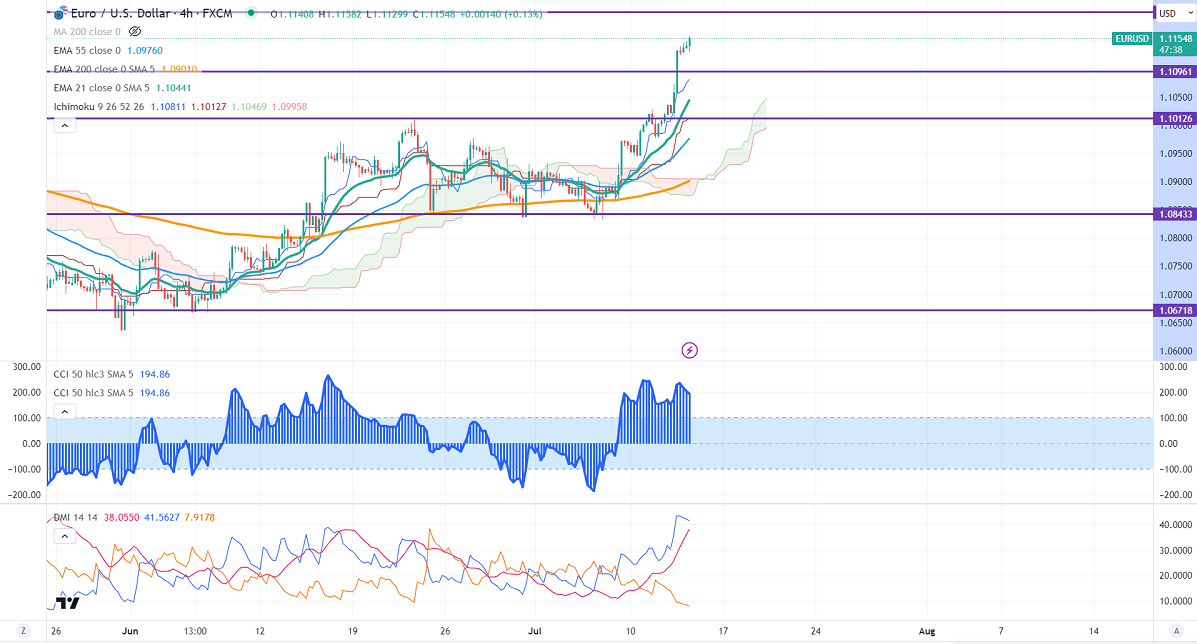

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.10731

Kijun-Sen- 1.10079

EURUSD surged more than 150 pips after hitting a low of 1.10034 on weak US inflation. US CPI declined to 3% YoY in June, compared to a forecast of 3%. On a monthly basis, inflation dropped to 0.2% vs. the forecast of 0.30%. It hits a high of 1.11582 and is currently trading around 1.11564.

Markets eye US PPI data for further direction.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in July increased to 92.4% from 90.5% a week ago.

The US 10-year yield pared most of its after dismal US CPI. The US 10 and 2-year spread narrowed to -85% from -110%.

The pair trades above short-term 21 EMA, 55 EMA, and long-term (200-EMA) in the 4-hour chart. Any indicative break above 1.1180 confirms intraday bullishness; a jump to 1.1225/1.13000 is possible. The near-term support is around 1.1100. The breach below targets 1.1050/1.1000.

Indicator (4-hour chart)

CCI – Bullish

Directional movement index – Bullish

It is good to buy on dip around 1.1125-28 with SL around 1.070 for a TP of 1.1250.