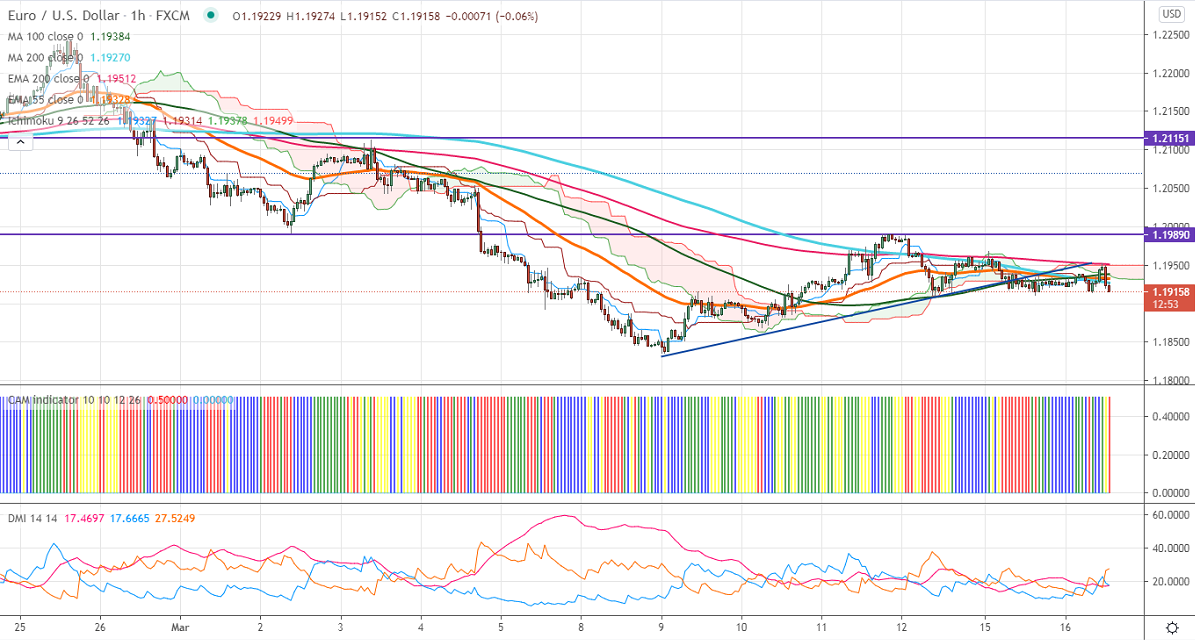

Ichimoku analysis (1 Hour chart)

Tenken-Sen- 1.19327

Kijun-Sen- 1.19314

EURUSD has once again declined after a minor jump above 1.19518 despite the weak US retails sales. The retail sales dropped by 3% in Feb compared to a forecast of -0.5. The January data was revised to 7.6% from 5.3% as previously reported. DXY is consolidating in a narrow range between91.965 and 91.67 for the past two days. The intraday bullishness only if it breaks 92. EURUSD hits an intraday low of 1.19152 and is currently trading around 1.19163.

US 10- year bond yield lost more than 0.5% after the data. It is trading slightly below the 1.60% level.

Technical:

The pair is facing strong support at 1.1900. Any break below confirms minor bearishness, a dip till 1.1835/1.1800 likely. The near-term resistance is around 1.1960. An indicative breach above will take the pair to next level till 1.2000/1.2035/1.20634 (200- 4H MA). Short-term trend reversal only above 1.2260.

Indicator (1 Hour chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to sell on rallies around 1.1928-30 with SL around 1.1985 for the TP of 1.18300.