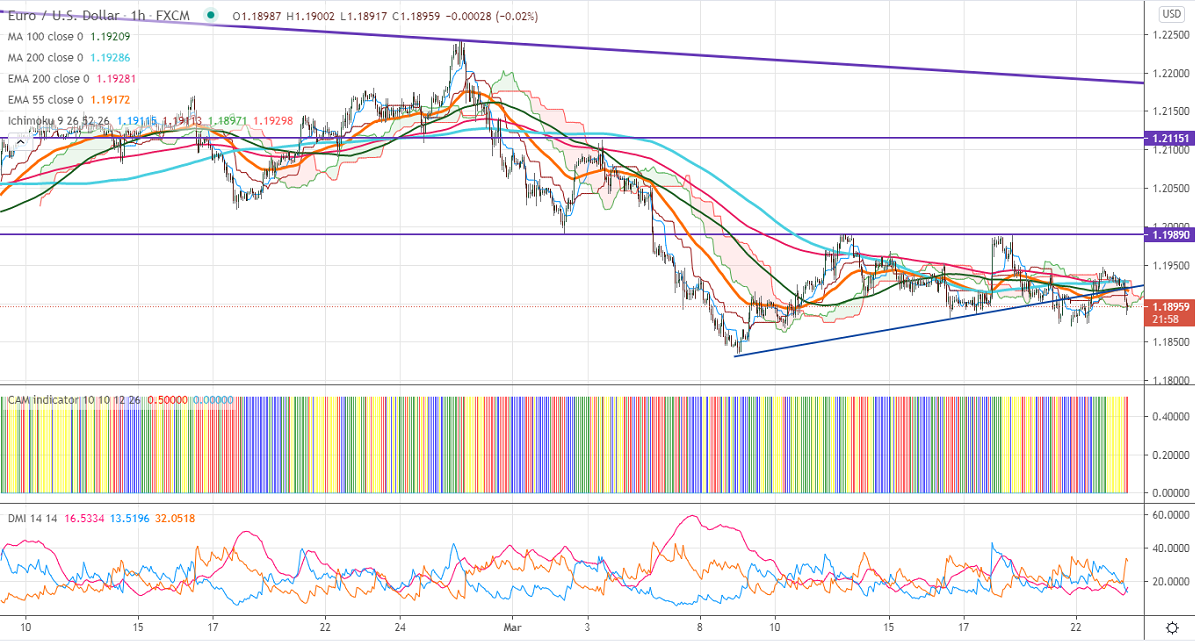

Ichimoku analysis (4 Hour chart)

Tenken-Sen- 1.19134

Kijun-Sen- 1.19107

EURUSD has once again declined after a minor jump till 1.19458. The extension of lockdown in Germany till Apr 18th and spread of British variant corona in Germany is putting pressure on Euro at higher levels. The slight profit booking in the US 10-year bond yield after hitting a multi-year high of 1.744% is preventing the pair from major sell-off. Market eyes US Fed chairman Powell's testimony on the quarterly CARES act before the House of Financial Services Committee for further direction.

DXY is trading above 92 levels. The intraday bullishness only if it breaks 92.20. EURUSD hits an intraday high of 1.18859 and is currently trading around 1.19059.

Technical:

The pair is facing strong support at 1.1835. Any break below confirms minor bearishness, a dip till 1.1800/1.1780/1.17335 likely. The near-term resistance is around 1.1930. An indicative breach above will take the pair to next level till 1.1965/1.2000/ 1.2030 (200- 4H MA)/1.20653. Short-term trend reversal only above 1.2260.

Indicator (1 Hour chart)

CAM indicator –bearish

Directional movement index – bearish

It is good to sell on rallies around 1.1928-30 with SL around 1.19850 for the TP of 1.1780.