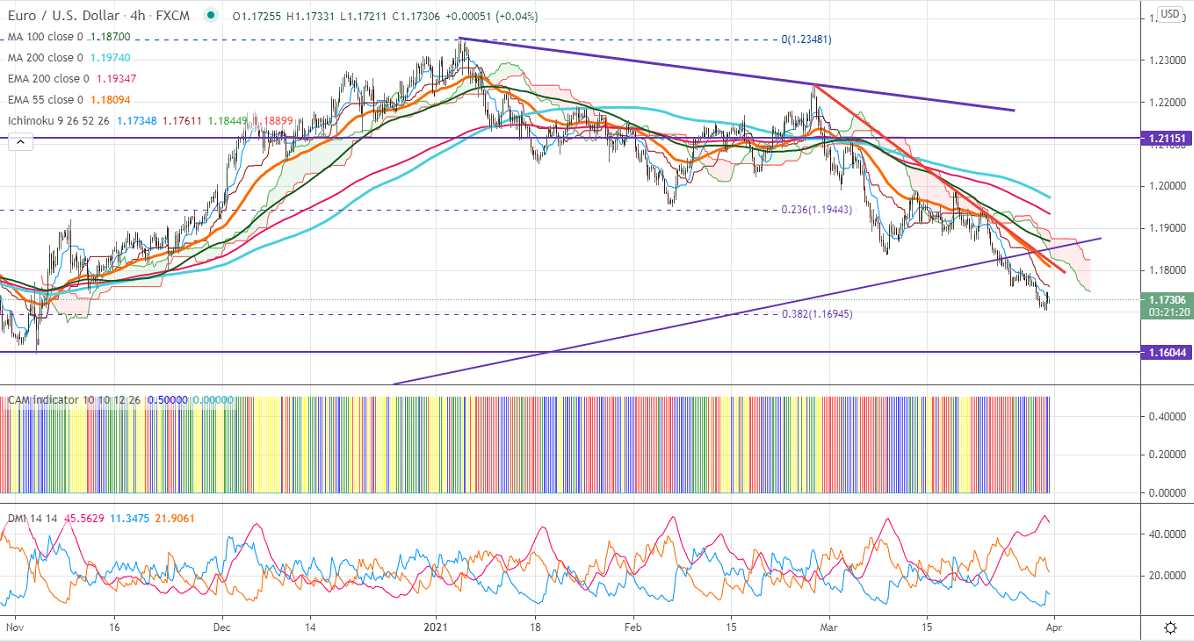

Ichimoku analysis (Hour chart)

Tenken-Sen- 1.17389

Kijun-Sen- 1.17651

EURUSD continues to trade weak after a minor pullback till 1.17478. The number of private jobs added in the US rose to 517K in mar well above the upwardly revised previous month 176K. But less than the estimate of 552k. Markets eye Biden speech today for further direction. The US 10-year yield surged more than 10% from a low of 11% to a low of 1.589%. Markets eye US Biden speech at 4:20 PM for further direction. direction. The slow vaccine rollout in European countries is also dragging the pair down.

DXY has halted its ten days of the bullish trend and shown a minor profit booking. Any intraday weakness only if it breaks below 92.90. EURUSD hits an intraday low of 1.17048 and is currently trading around 1.17310.

Technical:

The pair is facing strong support at 1.1700. Any break below confirms minor bearishness, a dip till 1.16600/1.1600 likely. The near-term resistance is around 1.1760. An indicative breach above will take the pair to next level till 1.1800/1.18451. Short-term trend reversal only above 1.2000.

Indicator (4 Hour chart)

CAM indicator –Neutral

Directional movement index – Neutral

It is good to sell on rallies around 1.1750-525 with SL around 1.1800 for the TP of 1.1600.