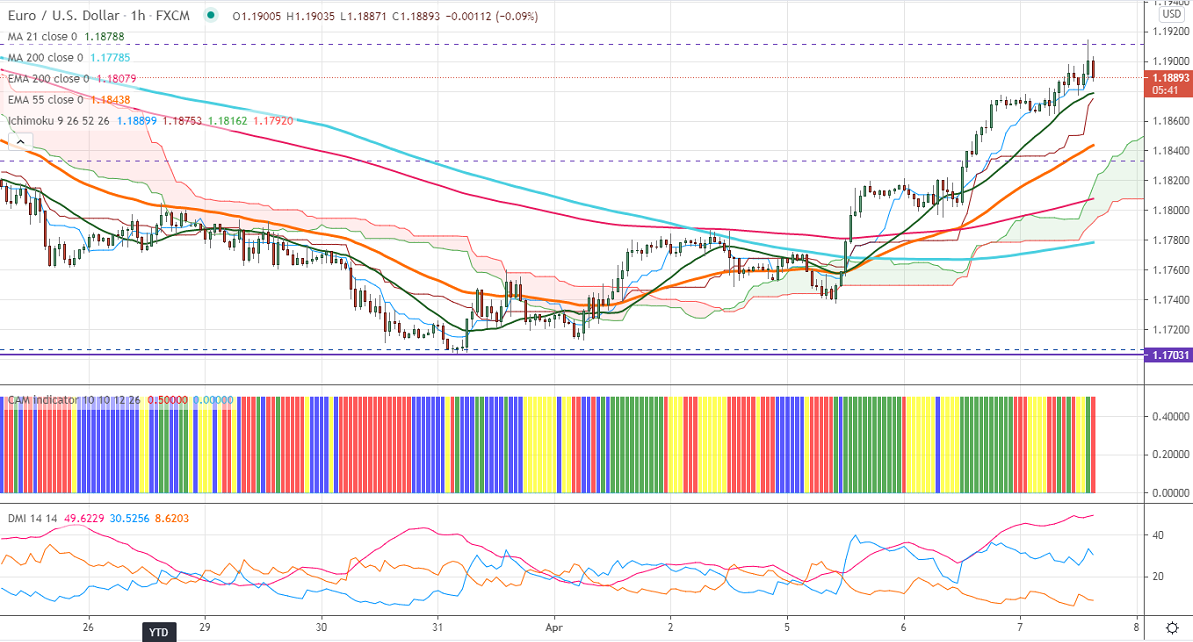

Ichimoku analysis (1 Hour chart)

Tenken-Sen- 1.18893

Kijun-Sen- 1.18704

EURUSD is trading higher for 3rd consecutive days and surged more than 150 pips on broad-based US dollar selling. The European positive vaccine rollout and upbeat services PMI is supporting Euro at lower levels. Markit German services PMI for Mar came at 51.5 compared to a forecast of 50.8. Markets eye US Fed FOMC meeting minutes and Biden infrastructure plan for further direction. The sell-off in US 10-year yield is also putting pressure on the US dollar.

DXY lost more than 100 pips from the temporary top at 93.43. Any intraday weakness only if it breaks below 92. EURUSD hits an intraday high of 1.19147 and is currently trading around 1.18892.

Technical:

The pair is facing strong support at 1.18500. Any break below confirms minor bearishness, a dip till 1.1800/1.1770 likely. The near-term resistance is around 1.1950. An indicative breach above will take the pair to next level till 1.2000/1.2048. Short-term trend reversal only above 1.2000.

Indicator (1 Hour chart)

CAM indicator –Bullish

Directional movement index – Bullish

It is good to buy on dips around 1.1868-70 with SL around 1.18000 for the TP of 1.2000.