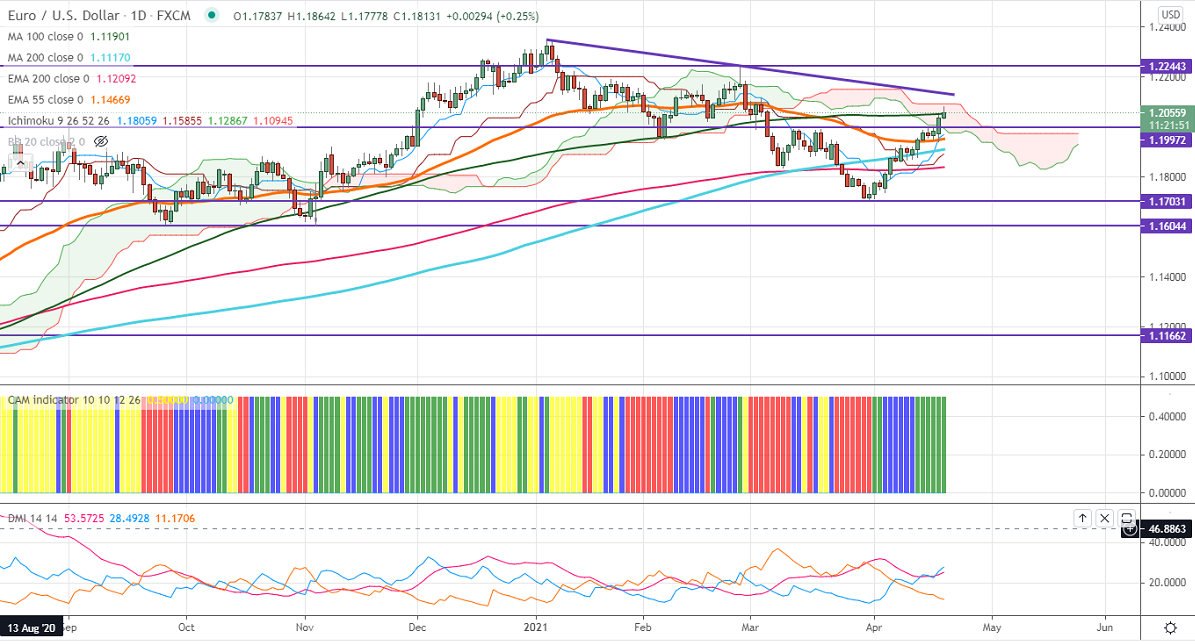

Ichimoku analysis (4 Hour chart)

Tenken-Sen- 1.19544

Kijun-Sen- 1.18761

EURUSD jumped sharply and holding well above 1.2050 on broad-based US dollar selling. The dollar index continues to trade weak despite an uptick in US bond yields. US 10-year yield surged more than 5.5% from a minor low of 1.53%. DXY is trading below 91 levels, a dip till 90.60 likely. The verdict on Johnson and Johnson vaccination by European Medicines Agency is expected on Tuesday after the US and Europe paused due to blood clots. EURUSD hits an intraday high of 1.20798 and is currently trading around 1.20575.

Technical:

The pair is facing strong support at 1.2040. Any break below will drag the pair down till 1.2000/1.1950/1.1900 likely. The near-term resistance is around 1.2080. An indicative breach above targets 1.21380/1.2170. Short-term trend reversal only above 1.2350.

Indicator (Daily chart)

CAM indicator –Bullish

Directional movement index – Bullish

It is good to buy on dips around 1.2040 with SL around 1.1990 for the TP of 1.2150.