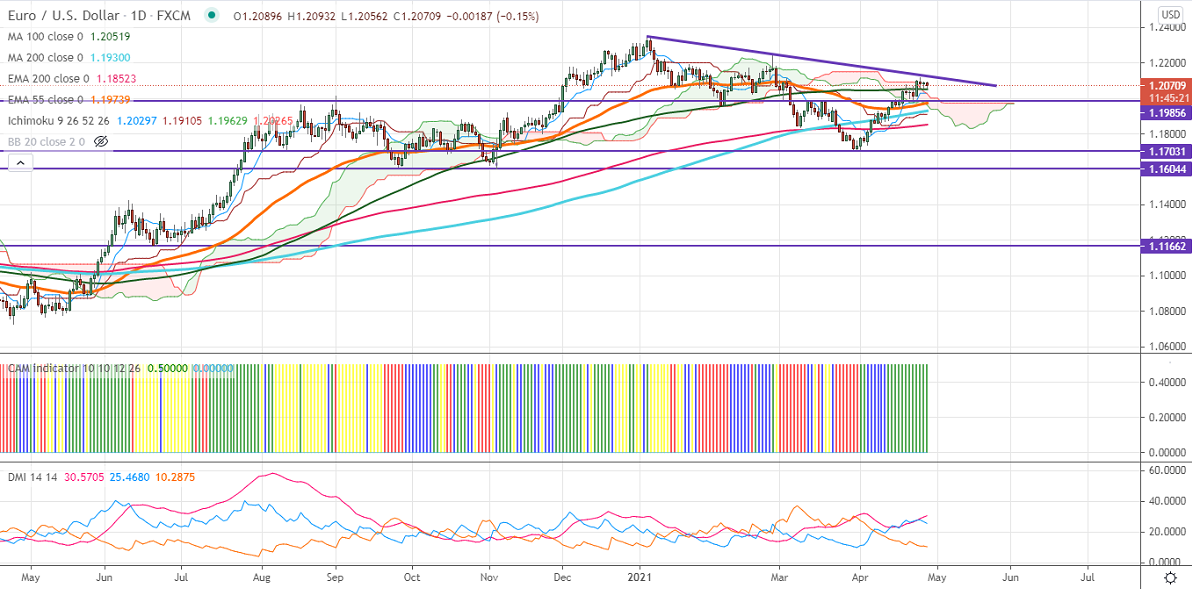

Ichimoku analysis (Daily chart)

Tenken-Sen- 1.20297

Kijun-Sen- 1.19105

EURUSD has taken support near 100- day MA and shown a minor recovery. Markets eye US Fed FOMC statement today for further direction. The Central bank is expected to keep interest rates unchanged. The investors awaiting Powell's press conference and future plans on a bond-buying program. The slight pullback in US bond yields is supporting the US dollar index at lower levels. The US 10-year yield surged more than 6.5% from a minor bottom 1.53%. The ECB president Lagarde's speech at 2:00 pm GMT will also be watched today. DXY is consolidating in a narrow range between 90.82 and 91.07 for the past two days. Any jump above 91.25 confirms minor bullishness. EURUSD hits an intraday low of 1.20562 and is currently trading around 1.20728.

Technical:

The pair is facing strong trend line resistance around 1.2120 level. Any violation above that level will take the EURUSD to next level 1.2180/1.2250. On the lower side, near-term support is around 1.2050 (100- day MA), and any indicative breach below targets 1.19980/1.1950/1.1900.

Indicator (Daily chart)

CAM indicator –Bullish

Directional movement index – Bullish

It is good to buy on dips around 1.2040 with SL around 1.1990 for the TP of 1.2150.