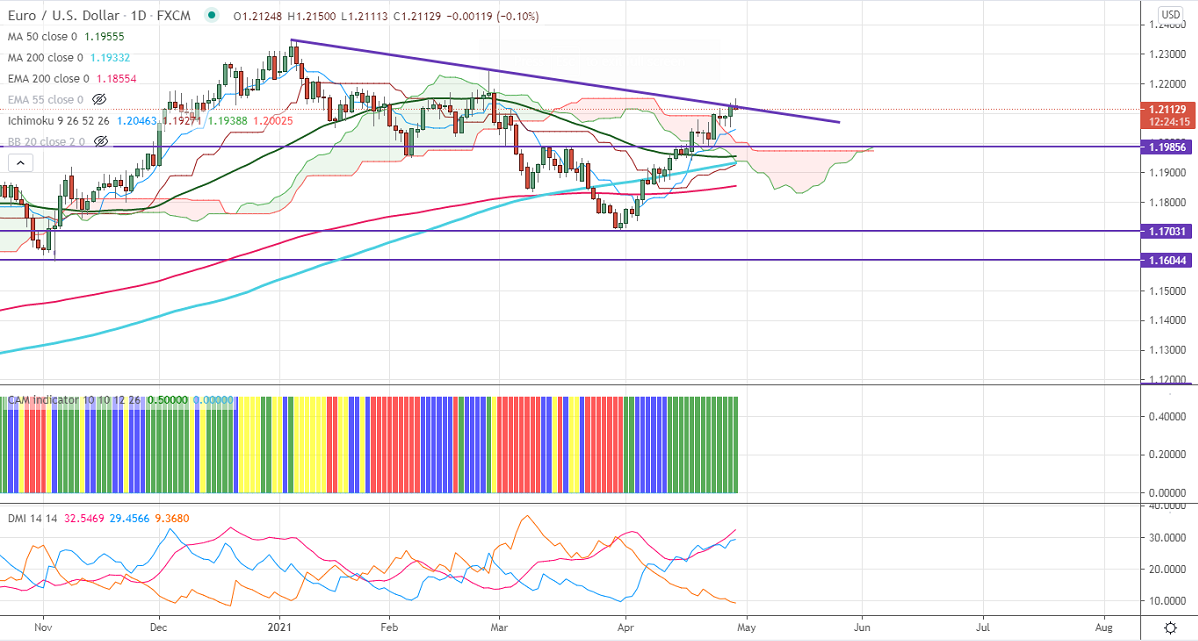

Ichimoku analysis (Daily chart)

Tenken-Sen- 1.20387

Kijun-Sen- 1.19195

EURUSD recovered sharply above 1.2100 after fed monetary policy. The central bank has kept its rates unchanged and left its $120bn bond-buying programs. They have said that vaccine rollout has strengthened economic activity and employment. The positive mood has decreased demand for Safe- haven and pushed EURUSD higher to 1.21500. Markets eye US advance GDPD and pending home sales data for further direction. DXY has lost more than 50 pips after minor pullback till 91.12. Any jump above 91.25 confirms minor bullishness. EURUSD hits an intraday high of 1.2150 and is currently trading around 1.21172.

Technical:

The pair is struggling to close above trend line resistance. Any daily close above 1.2120 confirms a bullish continuation. A jump till 1.2180/1.22432 is possible. On the lower side, near-term support is around 1.2090, and any breach below targets 1.2050 (100- day MA)1.19980/1.1950/1.1900.

Indicator (Daily chart)

CAM indicator –Bullish

Directional movement index – Bullish

It is good to buy on dips around 1.2090 with SL around 1.2045 for the TP of 1.2200.