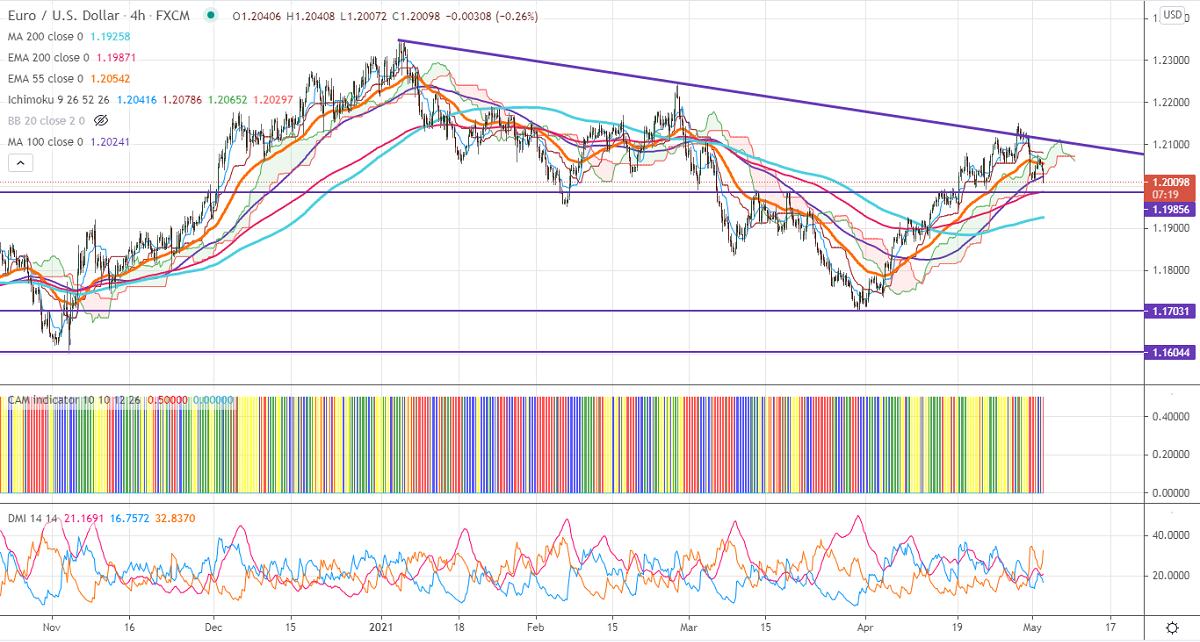

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 1.20416

Kijun-Sen- 1.20786

EURUSD has declined sharply after a minor pullback till 1.20758 on broad-based US dollar buying. The Fed chairman Powell said that the economic outlook is "clearly brightened" but recovery is uneven in the low-income group. The pair hits an intraday low of 1.20072. It is currently trading around 1.20206. The US ISM manufacturing index came at 60.7 for Apr slightly lowered compared to the forecast of 65%.DXY upside capped by 200-4H MA. Any convincing break above 91.50 confirms a minor bullish continuation. A jump to 91.90 likely.

Technical:

On the lower side, near-term support is around 1.2000, and any breach below targets 1.1950/1.1900. The pair is struggling to close above 100- day MA at 1.20520. Any daily close above 1.20520 confirms a bullish continuation. A jump till 1.2090/1.2120/1.2150 is possible.

Indicator (Daily chart)

CAM indicator –Bearish

Directional movement index – Bearish

It is good to sell on rallies around 1.2048-50 with SL around 1.2080 for the TP of 1.1950.