Ichimoku analysis (4-Hour chart)

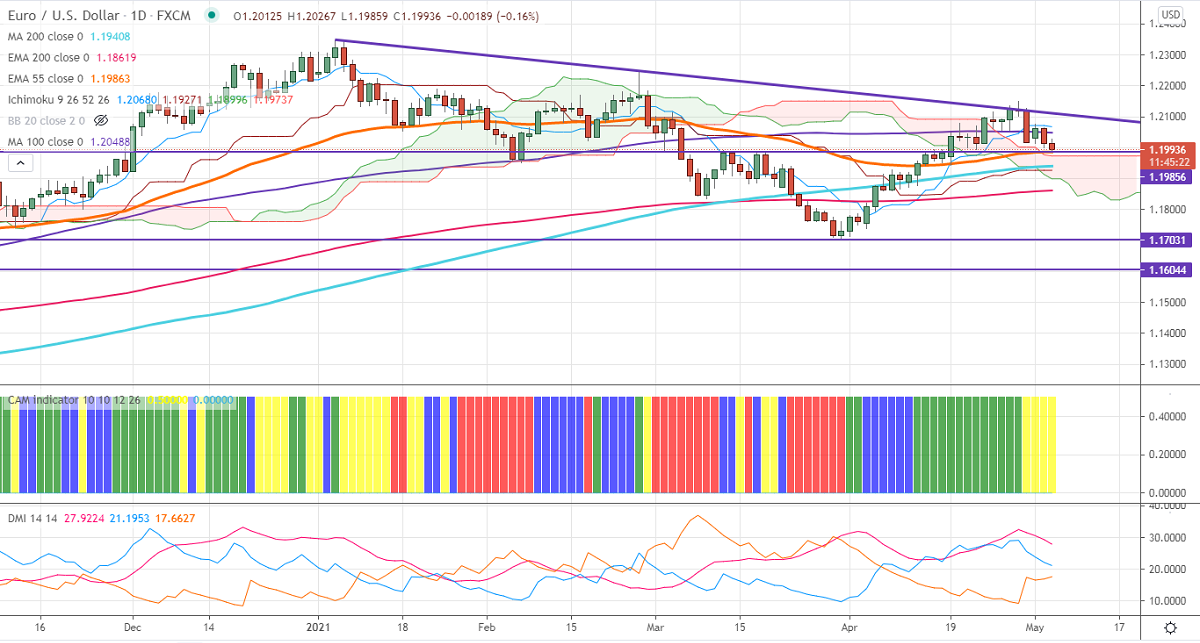

Tenken-Sen- 1.20719

Kijun-Sen- 1.19271

EURUSD continues to trade weak for fourth consecutive days and lost more than 150 pips on broad-based US dollar buying. The comments of a rate hike by US treasury Janet Yellen have fuelled a rally in the US dollar. DXY surged more than 100 pips from a temporary bottom of 90.42. Any convincing break above 91.50 confirms a minor bullish continuation. The Eurozone services PMI came at 50.5 in Apr compared to a forecast of 50.3. Markets eye US ADP and ISM services PMI for further direction.

Technical:

On the lower side, near-term support is around 1.19800, and any breach below targets 1.1950/1.1900. The pair's near-term resistance is around 1.20503 (100- day MA). Any daily close above 1.20520 confirms a bullish continuation. A jump till 1.2090/1.2120/1.2150 is possible.

Indicator (Daily chart)

CAM indicator –Neutral

Directional movement index – neutral

It is good to sell on rallies around 1.2018-20 with SL around 1.2060 for the TP of 1.1900.