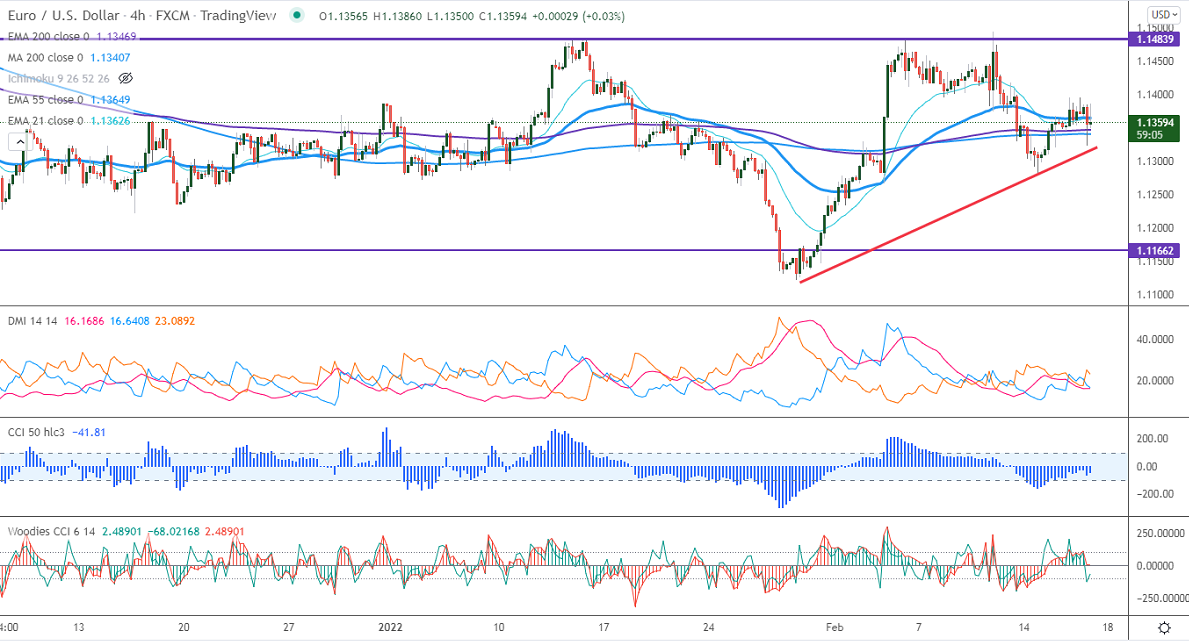

Intraday trend – Bullish

Major intraday resistance– 1.140

The pair recovered once again after hitting a low of 1.13232 today. Markets remain highly volatile on news that Ukraine fired mortar shells and grenades at four LPR locations. US retail sales rose 3.8% in Jan compared to a forecast of 2.1%. Markets eye US jobless claims and Philly fed manufacturing index for further direction. It hits an intraday high of 1.13794 and is currently trading around 1.13788.

Technical-

Any breach below 1.1320 confirms intraday bearishness. A dip till 1.1300/1.1230 is possible.

The immediate resistance to be watched is 1.1400; any violation above will take the pair to 1.1435/1.150/ 1.1580/1.1700.

Indicators (1-hour)

Directional movement index –Neutral

CCI (50) – Bullish

It is good to buy on dips around 1.1348-50 with SL around 1.1300 for a TP of 1.150.