EUR/USD pared some of its gains due tp profit booking. It hits a intraday low of 1.1455 and currently trading around 1.14736.

In April 2025, Richmond Manufacturing Index noted a steep drop in manufacturing in the Federal Reserve's Fifth District to -13 from -4 in March. All the main indicators such as shipments (-17), new orders (-15), and employment (-5) fell, along with a steep drop in the local business conditions index. The orders backlog decreased considerably to -24, and vendor lead times fell from a marginal standpoint. Manufacturers reported increased prices received and paid, expecting the same to prevail amidst inflationary pressures and tariff effects

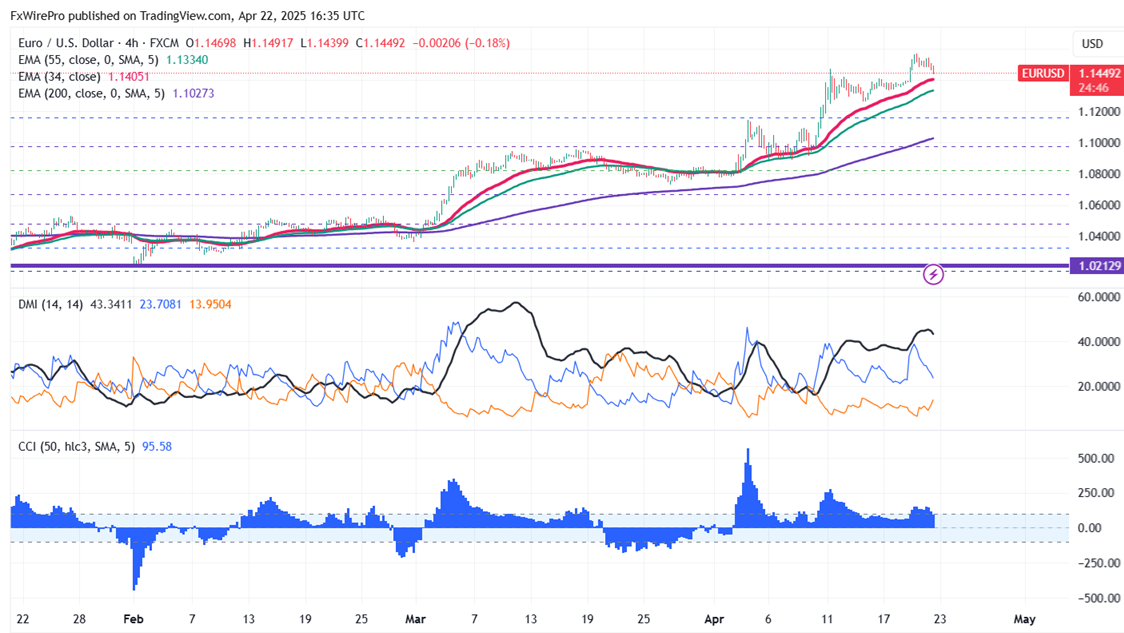

Technical Analysis of EUR/USD

The pair is holding above short and long term moving average in the 4-hour chart. Near-term resistance is seen at 1.1500; a break above this may push the pair to targets of 1.1570/1.1600. Major bullish momentum is likely only if prices are able to break above 1.160 targets 1.1660. On the downside, support is seen at 1.1450 any violation below will drag the pair to 1.1400/1.1330/1.1270/1.1240/1.1150/1.11000/1.10840/1.1000.

Market Indicators and Trading Strategy

Commodity Channel Index (CCI)- Bullish

Average Directional Movement Index (ADX) - Neutral

It is good to buy on dips around 1.140 with a stop-loss at 1.1330 for a target price of 1.160.