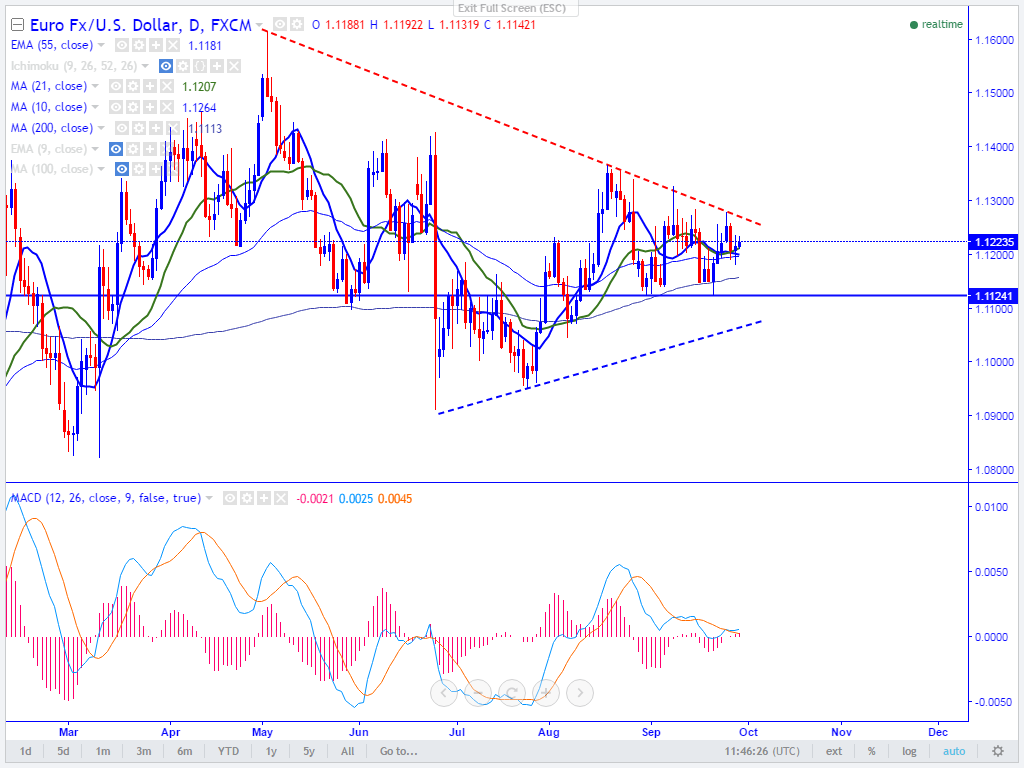

- Major Resistance – 1.1280 (trend line joining 1.16163 and 1.13660).

- EUR/USD has slightly recovered from the low of 1.11817 made yesterday. It is currently trading around 1.12140.

- The pair takes support near 100 –day MA and slightly jumped from that but it is struggling to close above daily Kijun-Sen. Any break above 1.1240 will take 1.1280.

- The pair is facing strong resistance around 1.1280 (trend line joining 1.16163 and 1.13660)and any slight bullishness can be seen only above that level.

- Short term weakness below 1.1120 level.

- On the lower side, major support is around 1.1150 (200- day MA) and any break below targets 1.1120/1.1045.

It is good to buy on dips around 1.1185-1.1190 with SL around 1.1150 for the TP of 1.1240/1.128