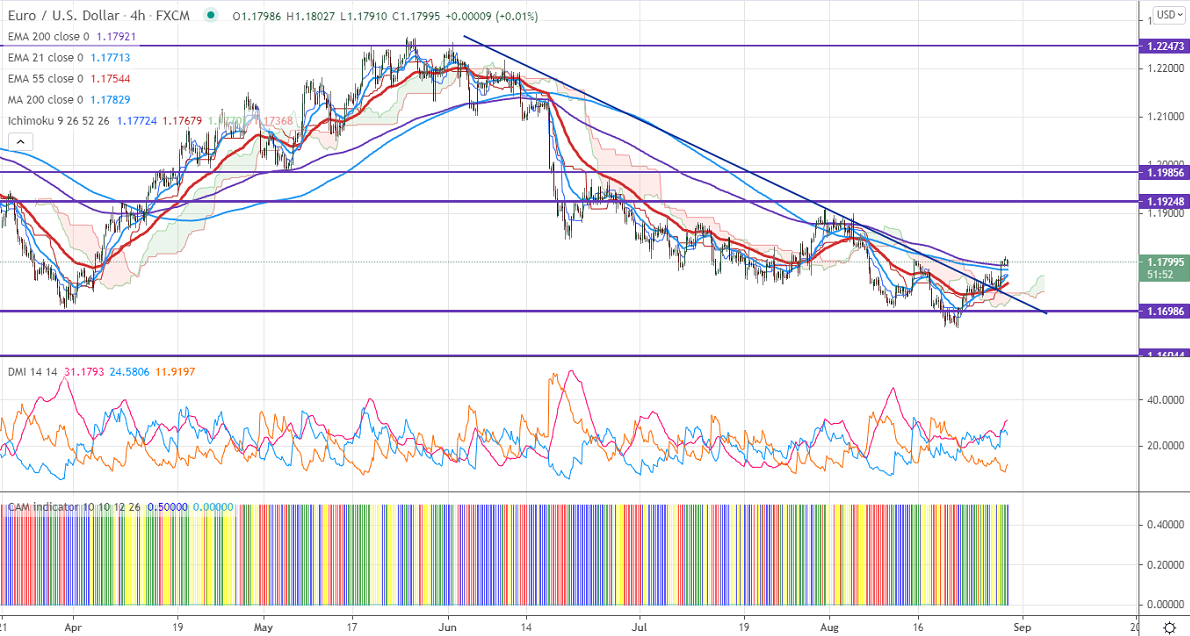

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 1.17724

Kijun-Sen- 1.17679

EURUSD hits three weeks high on Friday after dovish comments from Fed Chairman Powell. The speech gives hint that the central bank will be printing fewer dollars and to start tapering of bond-buying by this year's end. The US 10-year bond yield lost more than 4% after hitting a high of 1.375%. The spread of delta variants is preventing Euro upside.

Technical:

On the higher side, near-term resistance is around 1.1820 and any convincing breach above will take to the next level 1.18650/1.1900. The pair's near-term support is at 1.1780, break below targets 1.1750/1.1700/1.1660.

Indicator (4-hour chart)

CAM indicator-Bullish

Directional movement index – Bullish

It is good to buy on dips around 1.17825-850 with SL around 1.1750 for the TP of 1.1850.