Higher implied volatility ATM options cost more. This is intuitive due to the higher likelihood of the market 'swinging' in your favour. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

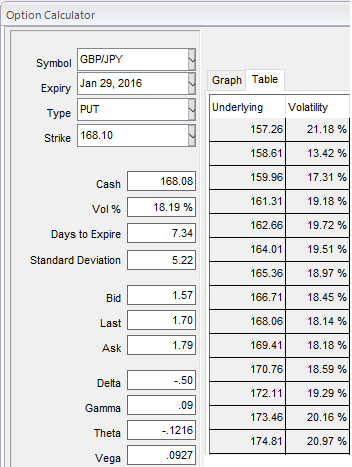

In the diagram, at the money put option with 7 days expiry trading with IV at almost 18% has descent delta at -0.50 with when gamma was at around 0.09 but this is not the same case with other strikes even though we've chosen in the money strikes.

The Gamma is useful when using the underlying market to hedge options, since it gives an idea of how much more or less you need to hedge in the underlying market if the market price moves by 1%.

With reducing volatility gamma adds to the risk and reward profile for both holders and writers.

So, before these continued downswings may hamper your forex portfolio as we think the current downtrend holds stronger in long run, so we've tailored our formulation of strategies as the risk appetite varies from different investors to different traders.

Considering GBPJPY trend has been extremely conducive for bears in long term but short term rallies are also expected as we listed out series of bullish flags in our recent technicals that signifies luring upswings in short run and strong bearish trend in long run.

The pair has pretty much reacted to our 1st targets at 177.125, T2 at 175 and for now for now an we urge for the targets at 163.500 and even at 160 levels are pretty much on the table upon holding the above stated resistance levels.

Hence, with hedging perspectives, using IVs, gamma and vega factors in order to neutralize volatility factor, put back-spreads are advocated so as to reduce the sensitivity and focus on hedging motive.

Hence, go long on 2W 1 lot of at the money -0.51 delta puts with gamma at 0.08, vega at 0.139, 1 lot of 1M out of the money -0.40 delta put and simultaneously shorting 3D At-The-Money put option is recommended to reduce the cost of hedging by financing long position in buying At-The-Money Puts, as the upswings are prevalent in short run, these ATM shorts would sooner become out of the money and initial premiums would be assure returns.

FxWirePro: Employ GBP/JPY ATM shorts on higher IV in backspreads

Friday, January 22, 2016 7:14 AM UTC

Editor's Picks

- Market Data

Most Popular