ETH prices trade flat ahead of the Fed meeting.

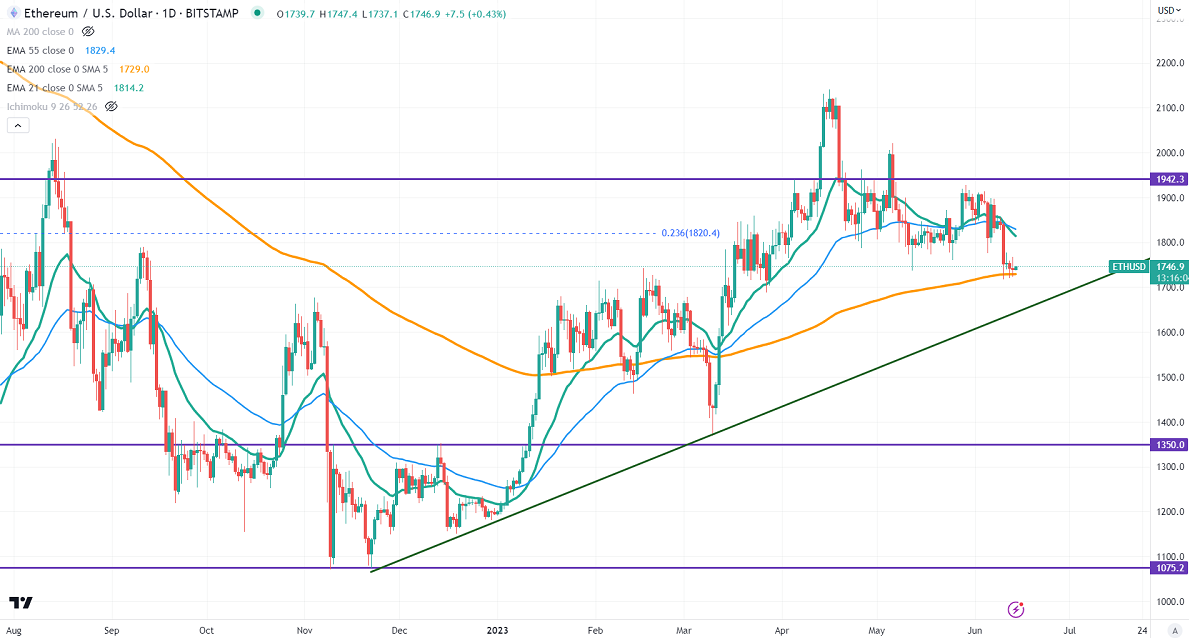

It holds below short-term support $1858-$1846 (21 and 55-day EMA).

ETHUSD is consolidating in a narrow range after a sell-off the previous week. The US dollar lost its momentum after weak US CPI.US core CPI rose 4% in May from 4.9% in Apr, the lowest level since Mar 2021 in Apr. US May inflation rate at 0.10% (MoM) Vs Est 0.30%. Markets eye US Fed monetary policy meeting today for further direction. Any dovish rate pause will have a positive impact on riskier assets. It hits a low of $17203 yesterday and is currently trading around $1745.

Major economic data for the week

Jun 14th, Federal funds rate (6 PM GMT)

The bullish invalidation can happen if the pair closes below $1570. On the lower side, the near-term support is $1700. Any break below targets $1670/$1600/$1570. Significant downtrend if it breaks $800.

The immediate resistance stands at around $1800. Any breach above confirms a minor pullback. A jump to $1900/$1973/$2030 is possible. A surge past $2050 will take Ethereum to $2294/$2500.

It is good to buy on dips around $1700 with SL around $1570 for TP of $2400/$2500.