ETHUSD trades higher on rate cut hopes.It hit a high of $2526 yesterday and is currently trading at around $2496.

ETH ETF (9 spot ETF) witnessed an outflow of $2.9 million on Aug 8th led by Grayscale's $19.8 million and Fidelity recorded the first day of outflow of $2.6 million since launch.

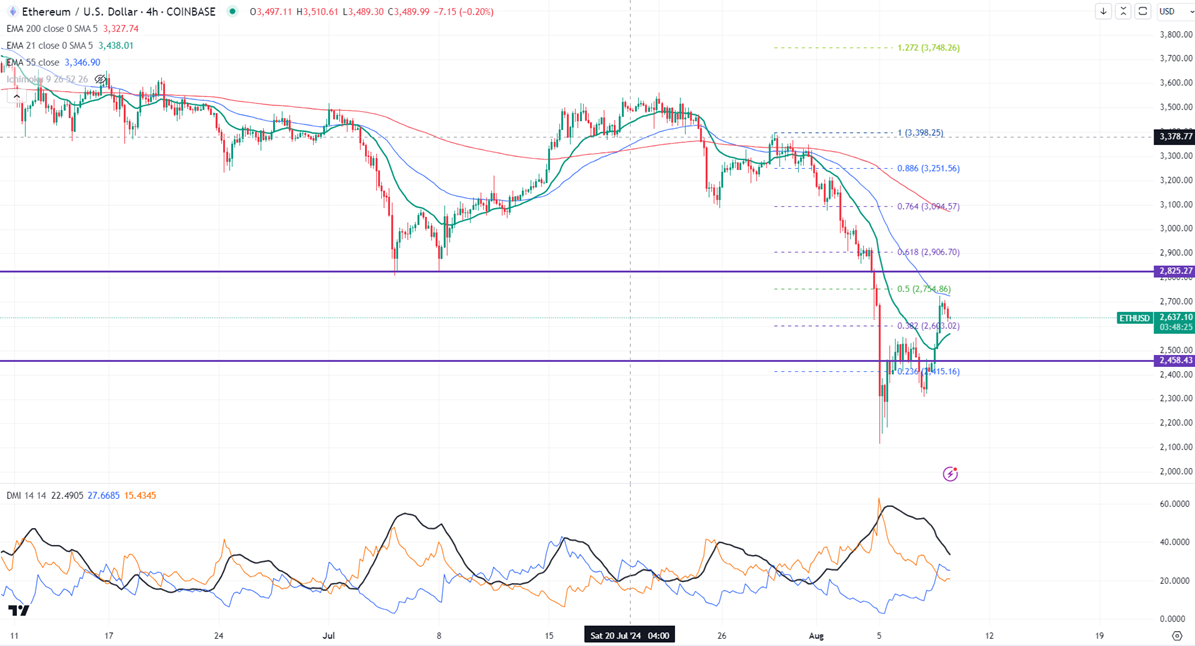

The intraday bullishness is possible if it holds above $2800.On the higher side, the near-term resistance is 2800. Any significant jump above targets $3000/$3200. Significant bullish continuation only above $3400.

The immediate support is around $2500. Any breach below $2500 confirms bearish continuation. A dip to $2300/$2100/$1800/$1500 is possible. A violation below $1500 will drag the Ethereum to $1000.

It is good to buy on dips around $2300 with SL around $2100 for TP of $2800/$3000.