We expect more muted market movements this week, after sharp market reactions were triggered by the ECB's policy under-delivery, and ahead of the all-important FOMC meeting on 16 December.

There is a risk of more near-term short squeezes in EURUSD if the market decides to further reduce EUR shorts. We prefer to sit on the sidelines in EURUSD positions for now, but will continue to look for catalysts or better entry levels to re-engage in strategic short EURUSD positions.

After the ECB, the market's attention will shift to the SNB's policy meeting on 10 December. We now expect the SNB to take a "wait and see" approach that would accompany a less aggressive ECB. Nevertheless, we still see CHF weakness ahead.

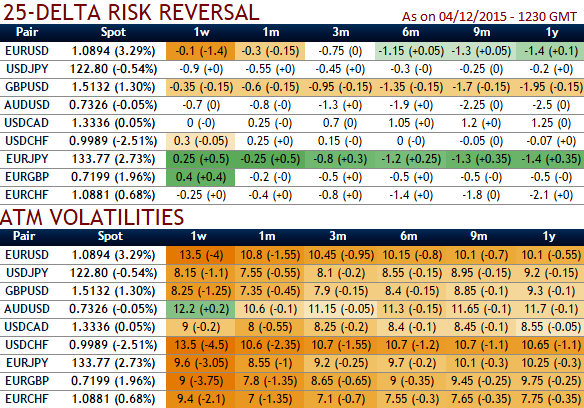

1w in to 10.0 vs 16.5 pre ECB, 1month 9.8 vs 12.5 and settles at 10.0 since 3month in to 9.9 from vs 11.5 and 1y 9.85 vs 10.7. 1week RR .05 vs 1.25 EUR call.

Huge expiries today 1.0800 (1.9Bln), 1.0850 (1.5Bln), 1.0900 (1.5Bln).

The OTC options market appears to be more balanced on the downward direction for EURUSD over the next 1-3-6m time horizon as delta risk reversal for EURUSD was turning into slightly negative while IV still remains highest among G7, dollar's gains most likely as per delta risk reversal computation coupled with recent booming economic numbers of U.S.

FxWirePro: Euro OTC volumes shrinking after ECB’s disappointment but still higher IVs ahead of Fed’s event

Monday, December 7, 2015 9:45 AM UTC

Editor's Picks

- Market Data

Most Popular