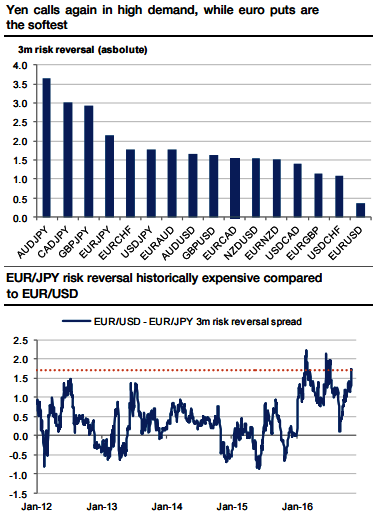

The excessive yen skew premium Yen calls are in high demand for all crosses (see above graph) as the market is behaving in a risk-off way. As we wrote here and here, the yen probably met an inflexion point after months of strength.

It is bid this week just ahead of the election, but a Clinton victory remains the central scenario and would provide immediate relief.

A Trump victory would pressure the USDJPY towards 100 but a break would not at all be to the BoJ’s taste, whereas the Fed is edging closer to a December hike, making a new rebound likely. Selling outright yen volatility or skew is not a reasonable trade given the imminent risk event, but selling the yen skew premium as a leg of a relative value trade appeals.

Stay short EURJPY rather than USDJPY skew, the EURJPY 3m skew is larger than the USDJPY skew (-2.1 vs -1.8), so that selling the former provides a higher premium.

Moreover, the EURJPY skew exceeding the USDJPY is not consistent in times of EUR topside volatility. On the contrary, euro bullishness should dampen the EURJPY skew, which is, therefore, an attractive Sell.

The spread between EURJPY and EURUSD 3m risk reversals is now very elevated historically, as it is exceeding 1.5 vols (see above graphs).

It never happened between 2012 and 2015 and such a situation happened only very transitorily this year. We expect the gap between EURJPY and EURUSD skews to tighten.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand