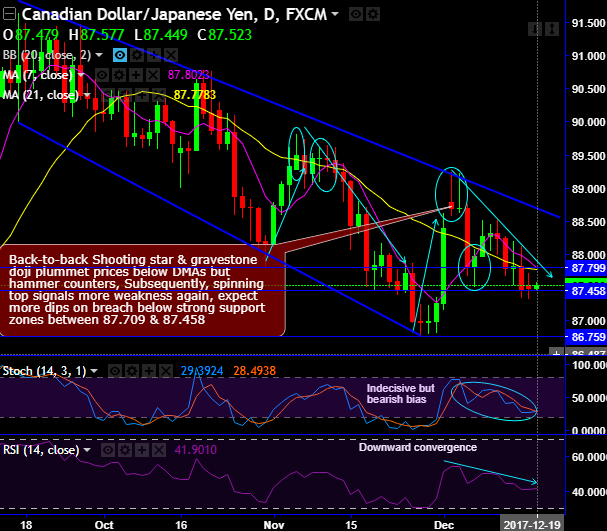

Chart and candlestick pattern formed- Sloping channel, Shooting star, and gravestone doji at 88.691, 88.698 respectively (on daily plotting) and rising wedge pattern (on weekly plotting).

Please observe the occurrence of the shooting star and gravestone doji patterns which are bearish in nature, as a result, CADJPY intermediate bears resume exactly at wedge resistance on weekly plotting as well.

Subsequently, the current price has slid well below DMAs and EMAs.

Contemplating and synthesizing these chart and candlestick patterns, coupled with the fact that the intermediate trend has gone in the downtrend, and the failure swings at the wedge resistance, in addition, indicates weakness in this pair.

Most importantly, both the leading oscillators (RSI & stochastic) on both daily and weekly timeframes have been converging downwards to the ongoing price dips.

For now, the major supports are observed at 87.799 and 87.458 levels, the break of these levels and the sustenance below would likely to evidence more slumps upto 86.759 levels where the next strong supports are observed.

On the flip side, the next stiff resistances are at 87.709 and 88.0313 levels.

On a broader perspective, the prices are now attempting slide below 21EMA levels (i.e. 88.0700 levels) and head towards wedge baseline, thereby, one could expect more slumps as both the leading oscillators have been constantly converging downwards to signal weakness (refer monthly chart).

To substantiate this bearish stance, MACD has shown bearish crossover to signal the extension of the downtrend.

Trade tips:

It is wise to initiate shorts in futures contracts of near month tenor but maintain a strict stop loss of 88.907 levels, we advocate these shorts on trading grounds as well. With this leveraged product one can add magnified impact on the trade yields.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying shy above -105 levels (bearish), while hourly JPY spot index was inching higher towards 72 (bullish) while articulating (at 06:45 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

As you could see higher bearish sentiments in CAD and the bullish interest in JPY, the bears of this pair are most likely to extend slumps upon our above stated technical rationale.

FxWirePro launches Absolute Return Managed Program. For more details, visit: