New Zealand posted a NZD 1436 million trade deficit in September of 2016, compared to a NZD 1140 million shortfall a year earlier and beyond market projections of NZD 1125 million gap.

Exports dropped by 5.7 pct, led by lower sales of meat and edible offal. Imports rose by 1.8 pct, driven by growth in purchase of capital goods.

Technically, the major trend of NZDUSD that was in consolidation pattern has now been turning into slightly bearish owing to the mounting sentiments of the changes in the monetary policies of central banks in both NZ and the US continents; more downside traction is foreseen in the months to come as the current prices on monthly charts are well below 7&21EMAs with leading oscillators to signal selling momentum.

Most importantly, the market pricing for a November OCR cut has rebounded over the past week, from 66% to 84%, in good part due to RBNZ McDermott’s reminder the OCR will be cut further.

Currency Option Strategy: NZD/USD Put Ladder

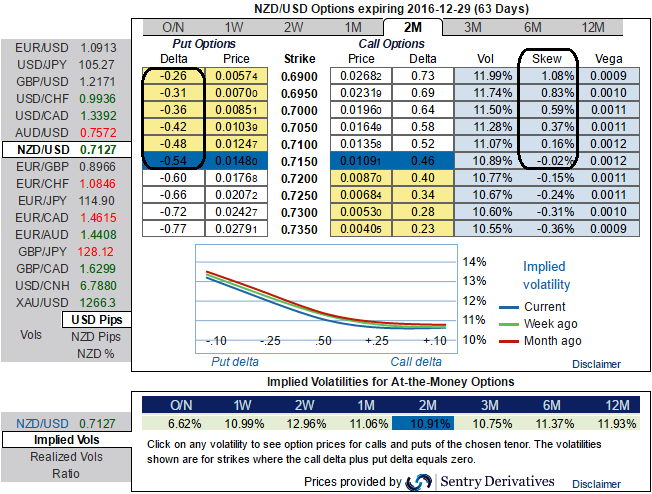

Rationale: Unlimited downside and limited upside profit potential and higher IVs favor option holders. Fundamentally, RBNZ is likely to ease in its monetary policy with 25 bps to keep OCR at 1.75% on November 10th, while FED rate hikes during Christmas also seems to be most likely event, moreover, Fed official signaling the further hikes in 2017 is an added pressures to NZDUSD.

2w ATM IVs are trending higher with decent numbers at 12% which means the market reckos the price has potential for large movement in either direction, and considering the skewness signifies the hedgers’ interests in OTM put strikes. These flashes imply that the higher likelihood of %change in premiums as the put contracts drifts into in the money (there exists the crux of derivative contracts).

Contemplating all these underlying factors, we advocate initiating longs in 1m (1%) ITM put option and simultaneously add shorts on 1w ATM put option and one more (1%) OTM put option of similar expiry.

Maximum returns are limited to the extent of initial credit received if the NZDUSD rallies above the upper breakeven point (BEP) but large unlimited profit can be achieved should the underlying exchange rate of NZDUSD makes vivid downswings below the lower BEP.

Please be noted that the narrowed tenors chosen in the strategy are just for demonstration purpose, use right expiries as stated above.

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close