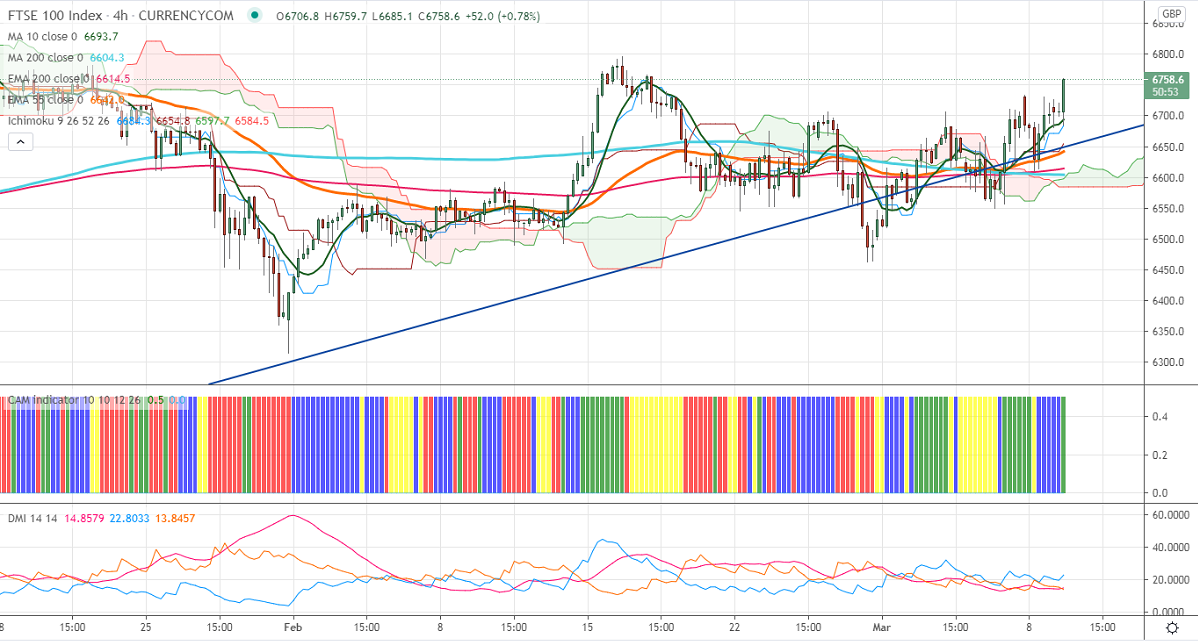

Ichimoku Analysis (4- Hours chart)

Tenken-Sen- 6671

Kijun-Sen-6641

FTSE100 has recovered more than 120 points after hitting a low of 6608. The decline in pound sterling and easing of lockdown in the UK is supporting FTSE at lower levels. The surge in crude oil prices after major Saudi facility got attacked by drone helped BP and Shell to trade higher which is major components in FTSE100. The index hits an intraday high of 6755 and currently trading around 6754.80.

The near-term resistance to be watched is 6800; any violation above will take the index till 6890/6963. Significant bullish trend continuation only if it crosses 7000. On the lower side, near-term support is around 6680, and any violation below targets 6639/6600.

It is good to buy on dips around 6700 with SL around 66600 for the TP of 6960.