Ichimoku Analysis (1- Hour chart)

Tenken-Sen- 6710

Kijun-Sen-6639

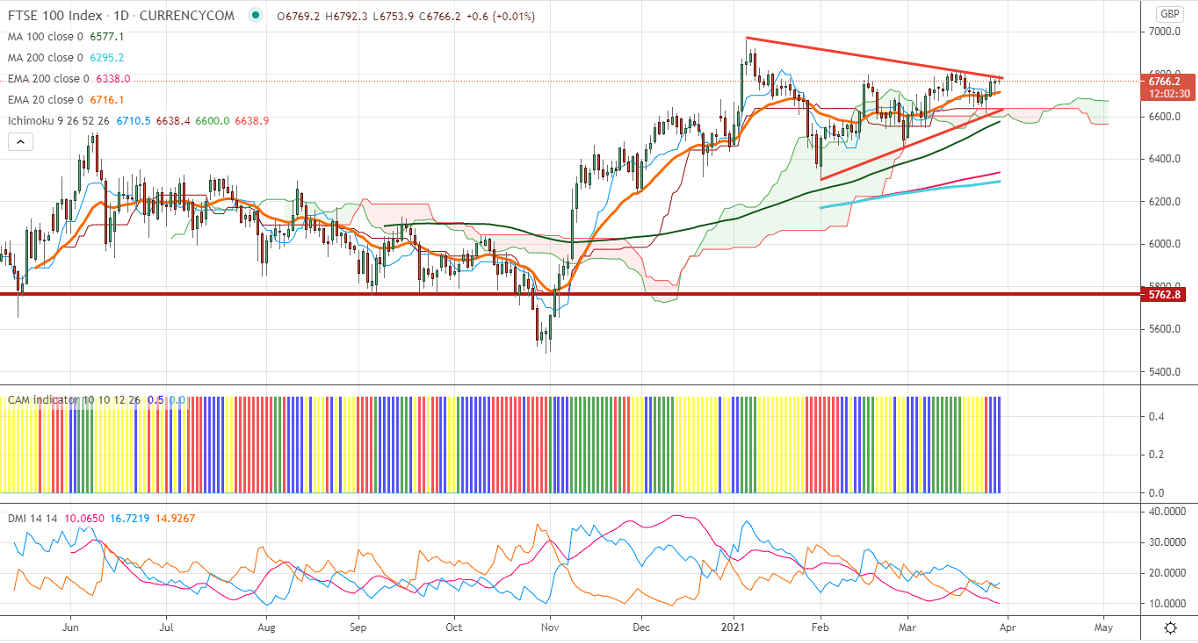

FTSE100 has taken support near 100-H MA and shown a nice recovery from that level. The upbeat market sentiment and positive US economic data are supporting global stock markets. S&P500 is trading higher and market valuations are well above the dot-com era. The lockdown has been imposed on major European countries like Germany, Poland, and France due to the third wave of the corona is preventing the stock markets from further upside. FTSE100 hits an intraday high of 6775 and currently trading around 6765.90.

The near-term resistance to be watched is 6810 any break above will take the index till 6825/6889/6963. Significant bullish trend continuation only if it crosses 7000. On the lower side, near-term support is around 6680, and any violation below targets 6640/6600/6549.

Indicator (1 Hour chart)

CAM indicator – neutral

Directional movement index – neutral

It is good to sell on rallies around 6810-15 with SL around 6890 for the TP of 6600.