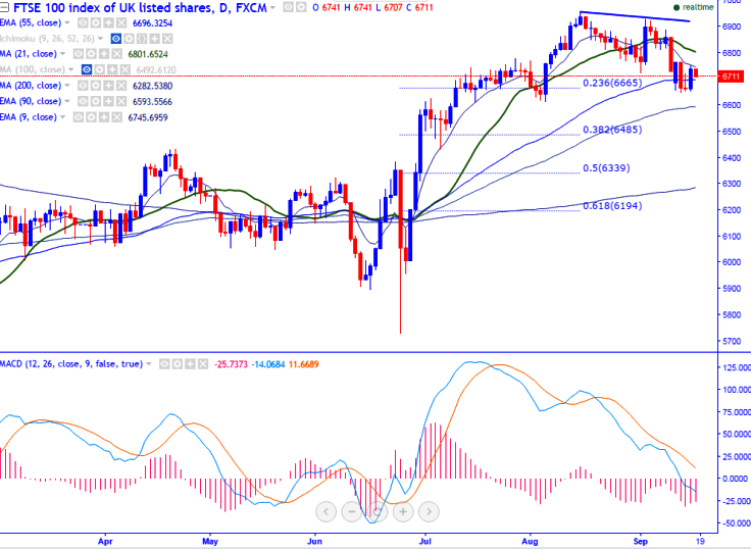

- Major resistance – 6757 (9- day EMA).

- Major support – 6610 (Aug 8th 2016 low).

- The index has recovered sharply from the low of 6647 made yesterday. It is currently trading around 6727.

- FTSE100 upside has been capped by 9-day EMA and any further bullishness can be seen only above 6755.

Any break above 6755 will take the index to next level till 6810 (21- day MA)/6930 (Sep 2nd high).

- On the lower side, support stands at 6590 (90- day EMA) and break below will drag the index down till 6488 (100-day MA)/6340.

It is good to sell on rallies around 6720-30 with SL around 6830 for the TP of 6610/6485