The back and forth in the NAFTA renegotiations has been the main driver of CAD exchange rates in recent months. In the interim, we expect the broad USD to continue to appeal to its countercyclical properties and continue to ignore implicit support from shorter-term supportive rate differential arguments.

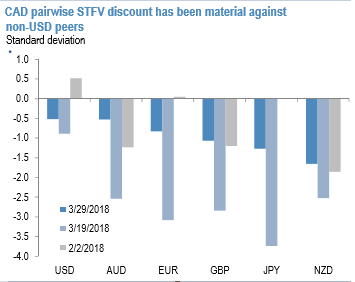

While we have for most of this year flagged and tracked CAD relative underperformance, particularly versus non-USD peers, and how this has driven a particularly large discount in CAD. While this discount has narrowed somewhat in the past week, it remains materially large. The BoC had identified uncertainty about the direction of the NAFTA negotiations as an important factor of uncertainty that had clouded the outlook - and thus also the probability of further interest rate hikes in the near future. The risk for that has declined which increases the likelihood of the Bank of Canada's continuing its rate hiking cycle, which supports CAD.

On a USDCAD basis, CAD is near short-term fair value (STFV), but this against context where as recently as 1-Feb, CAD was 4% rich to the USD, and also against a context where the broad dollar has remained very persistently in large discount, by roughly 4-5% currently and on-average since October last year versus standard rate-spread models. In other words, CAD reflects a similar discount to the broad dollar when paired against other currencies (refer above chart).

While there are numerous idiosyncratic CAD factors in play, some more relevant than others (e.g. we think the oil transport bottleneck is modestly relevant but housing market risks are much less relevant near-term), the unique risks to US trade policy has been the most prominent and obvious candidates for driving CAD FX risk premium, given the unique exposure to NAFTA, to steel and aluminum tariffs, and due to its large footprint to US import demand. Hence, a material NAFTA breakthrough which narrows these trade risks should materially impact CAD’s risk premium.

Idiosyncratic trades (long CADJPY and NOKSEK) have performed well. Add to CAD longs through a USDCAD put RKO ahead of BoC next week but take profits on NOKSEK as the undervaluation there has been eliminated while keeping a core short in EURNOK.

Buy a 2m 1.25/1.22 USDCAD put RKO (spot ref. 1.2573).

Currency Strength Index: FxWirePro's hourly USD spot index is displaying shy above -65 levels (which is bearish). While hourly CAD spot index was inching towards 77 (bullish) while articulating (at 06:00 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics