On economic data radar over next fortnight:

BoJ economic outlook report, monetary policy decision and policy rates on Oct 31st.

GDT price index, Kiwis’ unemployment rates and inflation reports are scheduled to be announced on Nov 1st.

Japanese Current account balance followed by machinery tools orders on Nov 8th.

New Zealand monetary policy (OCR) followed by RBNZ policy statement and press release on Nov 9th.

Although the short term trend of NZDJPY has been showing little strength, major downtrend and consolidating patterns in medium term should not be disregarded.

Moreover, the genuine threat for this pair is that RBNZ is expected to cut the OCR further to 1.75% in next monetary policy meeting - a record low (scheduled on 10 November).

That has been well signaled by the RBNZ, which has acknowledged the strong economy but cites very low inflation which, at 0.2% YoY, is well below its 2.0% target midpoint.

The slight downward grind this year has morphed into a more sideways grind centered on 74.

It’s approaching a breakout, with perceived BoJ direction likely to dictate whether the break is upwards or downwards. It’s low key calendar this week except dairy price index.

Most importantly, the market pricing for a November OCR cut has rebounded over the past week, from 66% to 84%, in good part due to RBNZ McDermott’s reminder the OCR will be cut further.

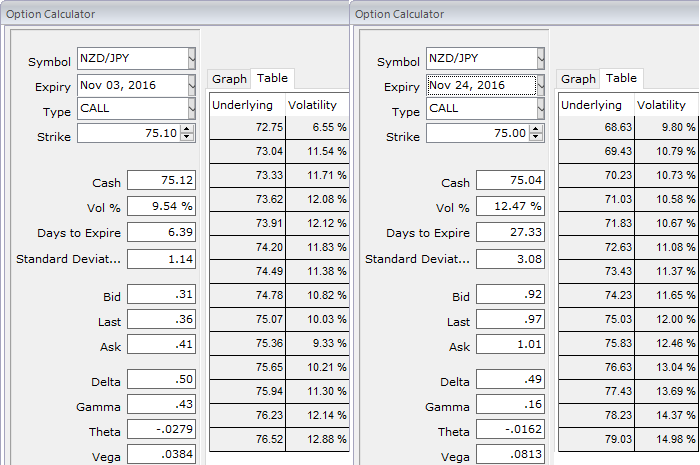

In OTC FX market of this pair, 1w ATM IVs are just shy above at 9.5%, and a tad below 12.50% in 1m tenor.

The execution of option strategy: Diagonal Put Ratio Spread (DPRS)

Go long in 1m ITM -0.71 delta put options, while simultaneously short 2 lots of 1w (1%) OTM puts with positive delta.

This spread is a neutral strategy that involves buying a number of put options and writing more put options and maturity at a different exercise price with reduced debit.

It is a limited return with the unlimited risk options trading strategy that is executed when the options trader reckons that the underlying spot FX would experience little volatility in the near term.

The long leg of the strategy would monitor major downtrend and prevailing upswings would make OTM shorts go worthless. Thereby, the total cost of the strategy would be reduced while bearish risks in the major trend would also be mitigated.

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal