NZD faces headwinds, even in a clearly weak USD environment. Domestic growth has weakened, the central bank’s inflation forecasts have been revised materially lower, net immigration is slowing and business confidence has fallen significantly since the change of government. But with the central bank in a state of transition (new governor, new mandate), over the next couple of months, we don’t see any domestic monetary policy catalysts that would drive material NZD weakness in the near-term.

Over 2018, we see scope for underperformance from NZD, though this is now more contingent on ongoing confirmation that the RBNZ can credibly lag policy normalization in the G3, and perhaps on evidence that real assets (equities, housing) are threatened by late cycle growth dynamics and government intervention.

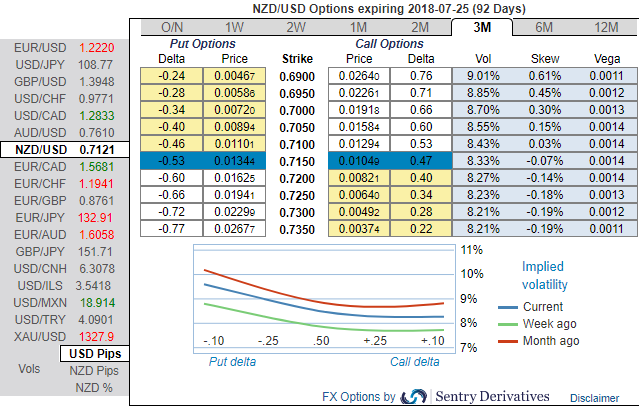

These developments are factored in OTC markets. Most importantly, please be noted that the ATM IVs of NZDUSD is on the lower side among G10 FX bloc (between 8% - 8.5%), while please be noted that the positively skewed IVs of the 3m tenor that signifies the hedgers’ interests in OTM put strikes. These skews signal underlying spot FX to drop below 0.69 levels. One can understand the hedging sentiments for bearish risks of this pair that are bearish.

Further out, though, we are bearish. The NZ-US interest rate advantage is rapidly shrinking and should eventually weigh, pushing NZDUSD towards 0.69 by mid-year which is in line with the positively skewed IVs. The 6m skews are targeting towards OTM put strikes at 0.67 (refer above nutshell). We expect NZDUSD to depreciate to USD 0.67 by end of H2’2018. Hence, we advocate delta put options of far-month tenors.

The delta is the amount an option price would move with every 1 point move in the NZDUSD spot prices. If expiry is not near, delta movement is not 1 point increase with 1 point increase in the underlying spot FX. Which means if the NZDUSD moves 1 point up, depending on the strike price of the option, the option will move less than 1.

The reason is that you buy option at a lesser price than the NZDUSD in cash for the same lot size, so why should you get profits equal to someone who bought the same NZDUSD in cash?

At the money (ATM) options usually have a delta of 0.5. If NZDUSD moves up 1 point – the price of the ATM option will go up by 0.5. In The Money options have more Delta than out of the money options. The deep in the money options move almost 1 to 1 with the underlying spot FX.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge