As stated in our earlier post on this pair’s technical lines, bears have extended slumps below 61.8% Fibonacci retracements and major downtrend still seems bearish despite abrupt upswings.

You can refer below weblink for more reading on technicals:

So any price bounces should not be deemed as a recovery in the major downtrend, instead one can capitalize these upswings to deploy fresh short build ups.

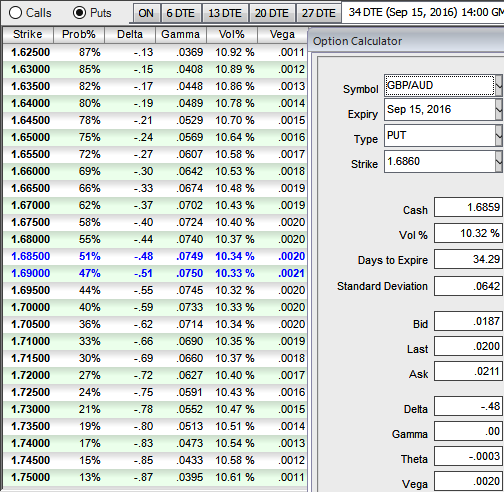

The implied volatility of GBPAUD has been bullish neutral for 1M expiries contemplating risk reversal signals.

At spot ref: 1.6859, go long in 2M/1W/2W GBPAUD put ladder (strikes 1.7667/1.6859/1.6525).

Indicative offer: reduces cost about little more than 50% vs prem for ITM strike only.

The long put ladder is a limited returns and unlimited risk strategy as it proportionately employs more shorts in the spread because the underlying FX pair will experience little volatility in the near term (refer IV and sensitivity table).

Ideally, to execute this strategy, the options trader purchases an (1%) in-the-money delta put, short an at-the-money put and short another (1%) out-of-the-money put of the same expiration date, however this’s not hard and fast, one can choose strikes as per his priorities.

Leaving only 100-125 pips between the former two strikes allows the profile to quickly reach the maximal possible leverage.

Unlike an usual put spread ratio, the maximal return is not reached on a given strike but over a wide region. It maximises the profitability of the trade via increased odds that the spot will trade in this region.

This short vega strategy is also short gamma so that an early spot depreciation will hurt the mark-to-market of the position.

Optimal leverage is only hit at the expiry and premature unwind is unlikely to be attractive before the two-thirds of the trade life.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close