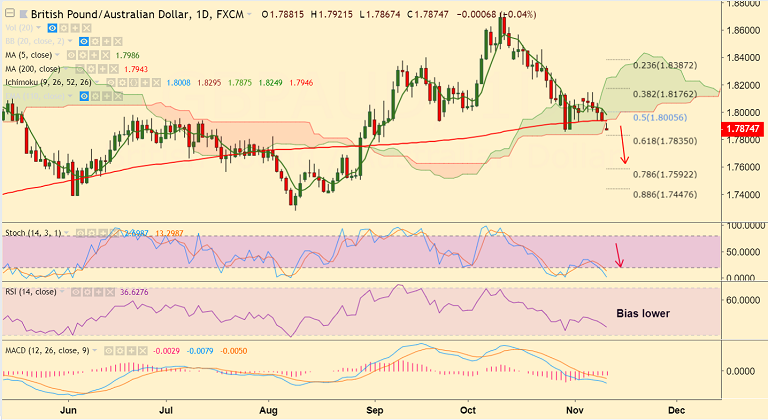

GBP/AUD chart on Trading View used for analysis

- GBP/AUD is extedning downside for the 6th straight week, slips below 200-DMA, we see scope for further downside.

- The pair has opened with a bearish gap, and recovery attempts were capped below 200-DMA.

- Brexit woes continue to plague the British pound. GBP/AUD primed for a continuation of last week's declines.

- Momentum studies are bearish, Stochs and RSI sharply lower, MACD supports downside.

- Next major bear target lies at 61.8% Fib at 1.7835. Violation there could see further weakness.

- On the flipside, retrace and close above 200-DMA could see some bounce back.

Support levels - 1.7835 (61.8% Fib), 1.7789 (Lower BB), 1.7592 (78.6% Fib)

Resistance levels - 1.7943 (200-DMA), 1.7986 (5-DMA), 1.80 (50% Fib)

Recommendation: Good to go short on upticks, SL: 1.7950, TP: 1.7835/ 1.78/ 1.7790

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios