- GBP/AUD holds above 1.83 handle, finds strong support 1H 110-EMA at 1.8292.

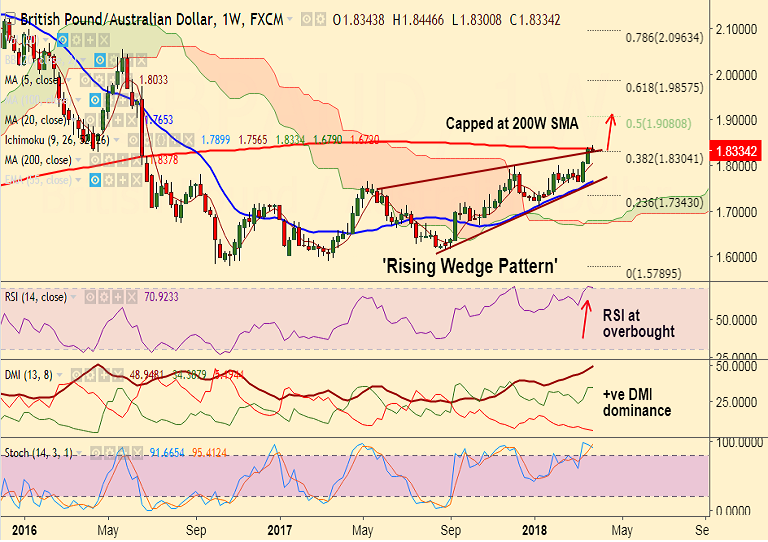

- The pair is trading in a 'Rising Wedge' pattern and price has shown a break above 'Wedge Top' at 1.8295 in last week's trade.

- The pair is currently trading in an extremely narrow range and finds major resistance at 200W SMA at 1.8378.

- Technical indicators on weekly charts are biased higher. RSI has edged above 70 levels and momentum studies are bullish.

- We see +ve DMI dominance and ADX is rising in support of the uptrend.

- Breakout at 200W SMA at 1.8378 will likely propel the pair higher. Scope then for test of 1.8655 (major trendline).

- On the flipside, the pair has broken below 1H 55-EMA at 1.8348, breach at 1H 110-EMA at 1.8292 could see dip till 20-DMA at 1.7948.

- Break below 20-DMA invalidates bullish bias.

Support levels - 1.8311 (5-DMA), 1.82, 1.8050 (Mar 19 low), 1.7948 (20-DMA)

Resistance levels - 1.8378 (200W SMA), 1.8655 (trendline), 1.9080 (50% Fib)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-GBP-AUD-hovers-around-major-trendline-resistance-18295-further-gains-only-on-decisive-break-above-1218804) is progressing well.

Recommendation: Bias higher, stay long.

FxWirePro Currency Strength Index: FxWirePro's Hourly GBP Spot Index was at -99.182 (Bearish), while Hourly AUD Spot Index was at -93.7747 (Bearish) at 0900 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest