- The British pound extends weakness ahead of UK inflation data due later in the European session.

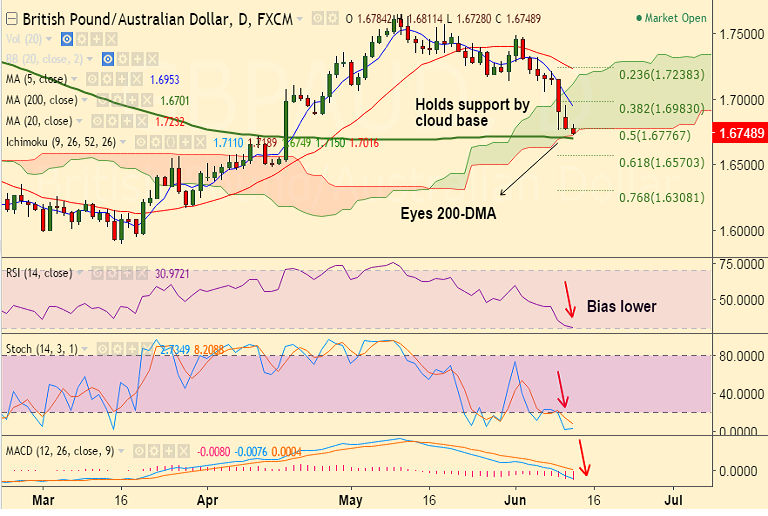

- GBP/AUD slumps further, slips below 50% Fib of 1.5902 to 1.7650 rise at 1.6777.

- Next immediate support lies at 1.6701 (converged 100 & 200-DMA). Violation there could see test of 1.6570 (61.8% Fib).

- British Pound is unlikely to strengthen significantly on the back of a strong CPI number. Political development in the UK would continue to be the main driver.

- Technical indicators on weekly charts are also biased lower, RSI and Stochs points south.

Support levels - 1.6701 (converged 100 & 200-DMA), 1.6570 (61.8% Fib), 1.6490 (Apr 14 low)

Resistance levels - 1.6776 (50% Fib), 1.68, 1.69, 1.6952 (5-DMA)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-GBP-AUD-rejected-at-highs-5-DMA-at-17212-caps-upside-745289) has hit all targets.

Recommendation: Stay short for 1.6701.

FxWirePro Currency Strength Index: FxWirePro's Hourly GBP Spot Index was at -70.6915 (Neutral), while Hourly AUD Spot Index was at 36.0996 (Neutral) at 0540 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.