• GBP/AUD strengthened on Tuesday as stability returned to the UK currency despite UK data showing British construction slowing in November.

• The S&P Global/CIPS UK Construction Purchasing Managers' Index (PMI) fell to a three-month low of 50.4 from 53.2 in October.

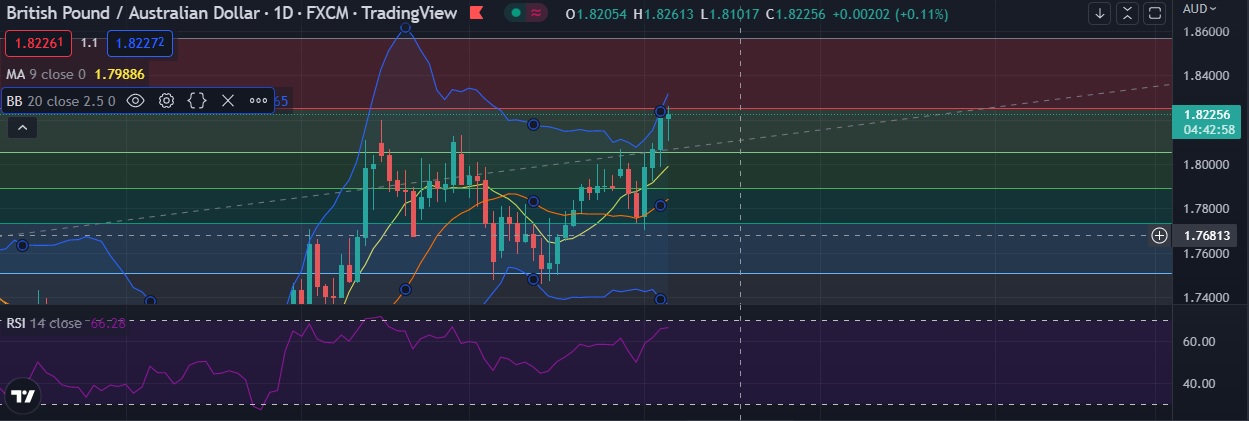

• A rally towards is 1.8300 level is possible if GBP/AUD bulls overcome resistance at 1.8253 (23.6%fib ).

• Technical signals are bullish as RSI is at 66, daily momentum studies 5 DMA, 9 EMA are trending up.

• Immediate resistance is located at 1.8253 (23.6%fib ), any close above will push the pair towards 1.8315(Higher BB).

• Strong support is seen at 1.8107(Daily low) and break below could take the pair towards 2.0190 (Trend line).

Recommendation: Good to buy on dips around 1.8200 with stop loss of 1.8120 and target price of 1.8300