Macro outlook:

In the UK, Politics continues to dominate the headlines, with further signs that the UK and the EU are entering the Brexit negotiations some distance apart.

PM May accuses the EU of interfering with the UK election

April PMIs unexpectedly strong

May Inflation Report to signal a tighter 7-2 vote but with the majority remaining patient on rate.

On the flip side, Australia got a softer start to Q1 GDP accounting, Australia’s nominal trade balance increased by A$8.9 billion in Q1, though the terms of trade release confirmed it was mainly a price, rather than volume story. Deflating nominal export growth by the export price index suggests that volumes fell about 3% QoQ.

RBA left the cash rate unchanged at 1.5% in May.

The Bank’s growth and inflation forecasts were also little changed across the forecast horizon.

Well, all these macros standpoints could propel GBPAUD either on upswings or downswings.

Consequently, in the prevailing puzzled environment you could observe that the momentary bulls of GBPAUD struggle to break and sustain above stiff resistance of 1.7650 levels, currently trading in non-directly to signal some bearish pressures. We advocate below hedging strategy with cost effectiveness that could hedge regardless of the swings on either side.

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

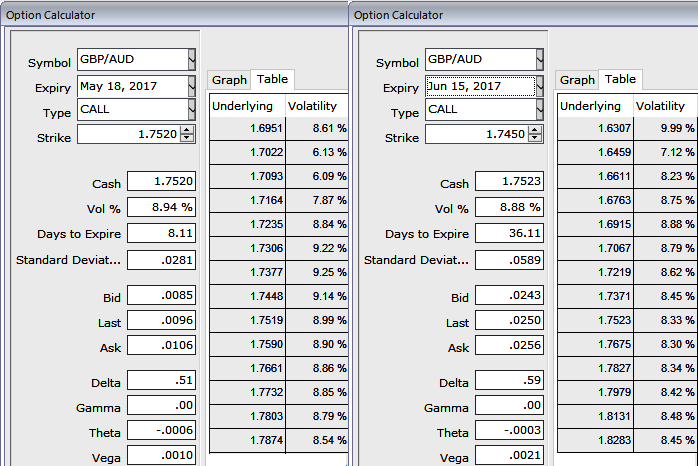

The execution: Initiate long in GBPAUD 3M at the money vega put, long 3M at the money vega call and simultaneously, Short theta in 1m (1.5%) out of the money call with positive theta or closer to zero.Theta is positive; time decay is bad for a buyer, but good for an option writer.

Rationale: As you could observe the vega of long leg (buy) call option position is 97 AUD and it implies that if IV increases or decreases by 1%, the option’s premium would have an impact in increase or decrease by 97 AUD, respectively. The Vega of a short (sell) option position is negative and an increasing IV is bad. Please be noted that the 1w IVs are just tad below 9%, whereas ATM calls are overpriced 23.5% more than NPV, hence, we foresee writing such exorbitant calls as there exists the disparity between IVs and option pricing.

Hence, we encourage vega longs and short thetas in the non-directional trending pair but slightly favours bearish strategy as the vega signifies the sensitivity of an option’s value owing to a shift in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed