- The Sterling found buying interest post-PMI data, GBP/AUD edges higher from session lows at 1.6423.

- UK’s manufacturing PMI bettered expectations in July, advancing to 55.1 vs. 54.3 forecasted and up from June’s 54.2 (revised from 54.3).

- Aussie largely muted after RBA left the official cash rate unchanged at 1.5%, as expected.

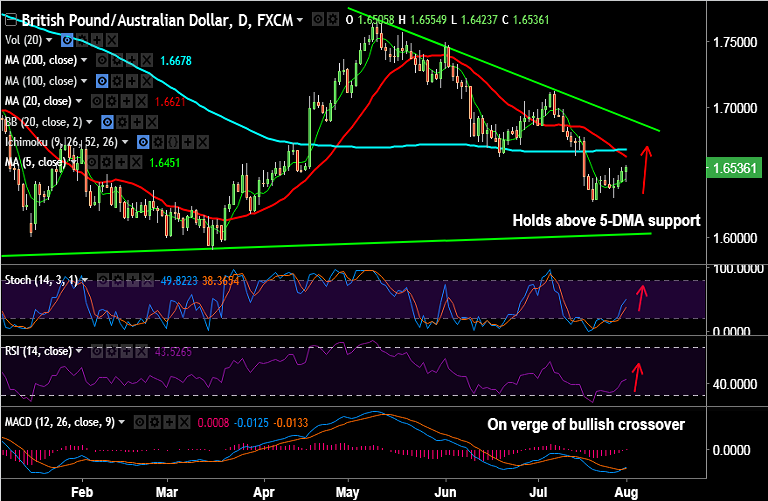

- Technical indicators have turned slightly bullish. RSI and Stochs have rolled over from over from oversold levels.

- MACD is on the verge of a bullish crossover on signal line, which if accomplished will add upside bias.

- Immediate resistance seen at weekly 5-SMA at 1.6610, break above will see test of 1.6678 (200-DMA).

- On the flipside, strong support seen at 1.63 (major trendline). Weakness only on break below.

- Focus now on BoE "Super Thursday" for a steer on whether record-low interest rates could soon be lifted.

Support levels - 1.65, 1.6450 (5-DMA), 1.63 (major trendline)

Resistance levels - 1.66, 1.6610 (weekly 5-SMA), 1.6621 (20-DMA), 1.6678 (200-DMA)

Recommendation: Good to go long on dips around 1.6480/1.65, SL: 1.6420, TP: 1.6555/ 1.6610/ 1.6675

FxWirePro Currency Strength Index: FxWirePro's Hourly GBP Spot Index was at 166.828 (Highly bullish), while Hourly AUD Spot Index was at -22.106 (Neutral) at 0940 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest