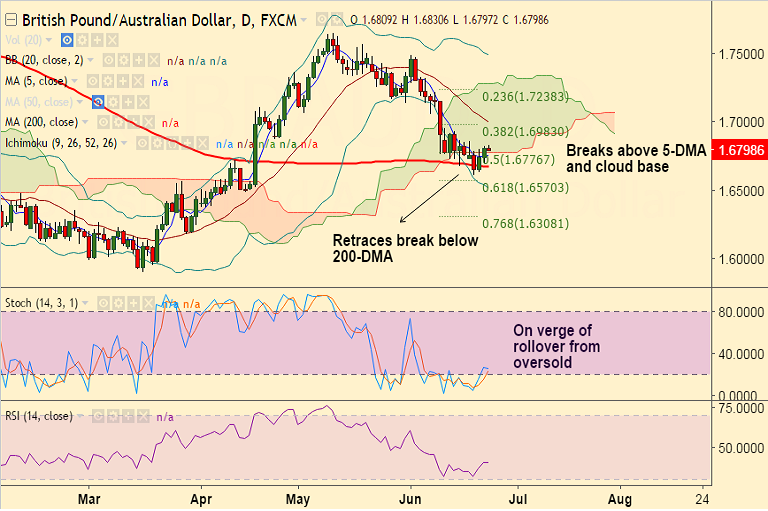

- GBP/AUD has retraced a brief dip below 200-DMA and has edged higher from multi-week lows at 1.6611.

- The pair has broken above 5-DMA and price action has pierced into daily cloud.

- Technical indicators do not provide any clear directional bias for now.

- A clear rollover of Stochs from oversold levels with RSI above 50 levels could see further upside.

- 200-DMA at 1.6671 is strong support on the downside and any weakness only on decisive break below.

Support levels - 1.6777 (cloud base), 1.6753 (5-DMA), 1.6671 (200-DMA)

Resistance levels - 1.6865 (June 19 high), 1.6983 (38.2% Fib), 1.7004 (20-DMA)

Recommendation: Wait for clear directional bias.

FxWirePro Currency Strength Index: FxWirePro's Hourly GBP Spot Index was at 7.72002 (Neutral), while Hourly AUD Spot Index was at -76.4661 (Neutral) at 0600 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest