• GBP /AUD rally extended above 1.8000 on Tuesday as positive surprise from labour market data out of Britain boosted sterling .

• UK's joblessness rate unexpectedly fell for a second month straight to 4.9% in the December-to-February period, the greater part of which the nation spent under a tight COVID-19 lockdown.

• The pound jumped 0.17% at 1.8040 versus Australian dollar, reaching near yesterday’s high.

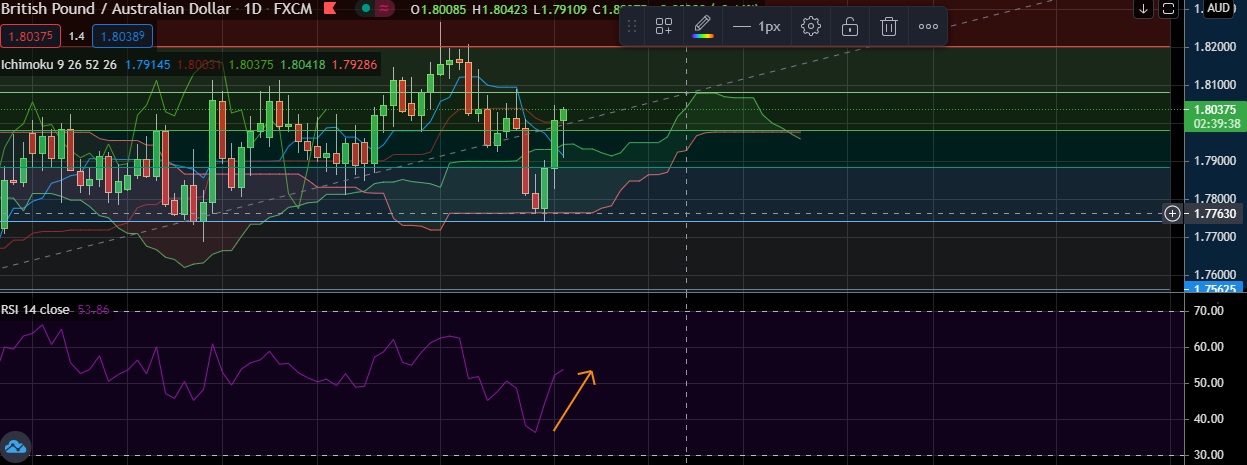

• Technical signals highlight upside bullish trend as daily RSI is rising and GBP /AUD is trading above the 11-DMA.

• Immediate resistance is located at 1.8134 (30 DMA), any close above will push the pair towards 1.8272 (50 % fib).

• Immediate support is seen at 1.7978 (50% fib) and break below could take the pair towards 1.7944 (Ichimoku Cloud Top).

Recommendation: Good to buy on dips around 1.8010, with stop loss of 1.7900 and target price of 1.8110.