- GBP/AUD is trading in an extremely narrow range, with a day's high at 1.7629 and a low of 0.7587.

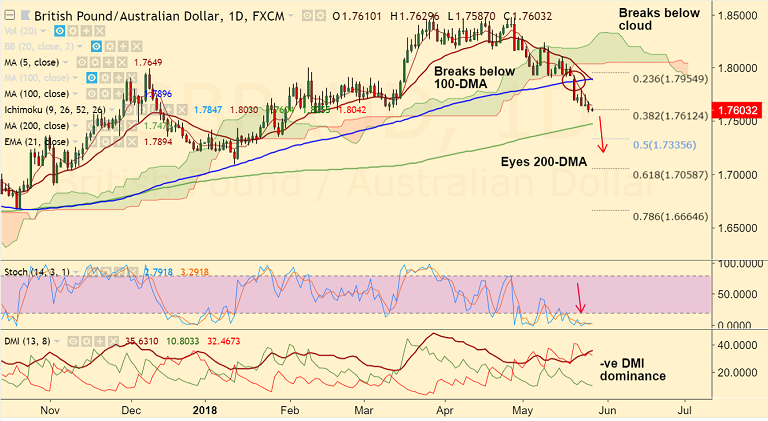

- The pair is extending break below daily cloud and 100-DMA, bias still bearish.

- Upside was rejected at 200W-SMA and any further upside only on break above.

- Momentum studies are heavily bearish and we see -ve DMI dominance.

- Trend indicators also support downside, next major bear target lies at 200-DMA at 1.7476.

- Violation at 200-DMA could see further weakness. Scope then for test of 61.8% Fib at 1.7058.

- Upside finds immediate resistance at 5-DMA at 1.7649. Break above 100-DMA invalidates bearish bias.

Support levels - 1.7575 (Feb 13 low), 1.75, 1.7476 (200-DMA)

Resistance levels - 1.7649 (5-DMA), 1.77, 1.7896 (100-DMA) 1.80

Call update: Our previous call (https://www.econotimes.com/FxWirePro-GBP-AUD-rejected-at-session-highs-stay-short-on-break-below-daily-cloud-1317918) has hit TP1/2.

Recommendation: Book partial profits. Hold for further weakness.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.