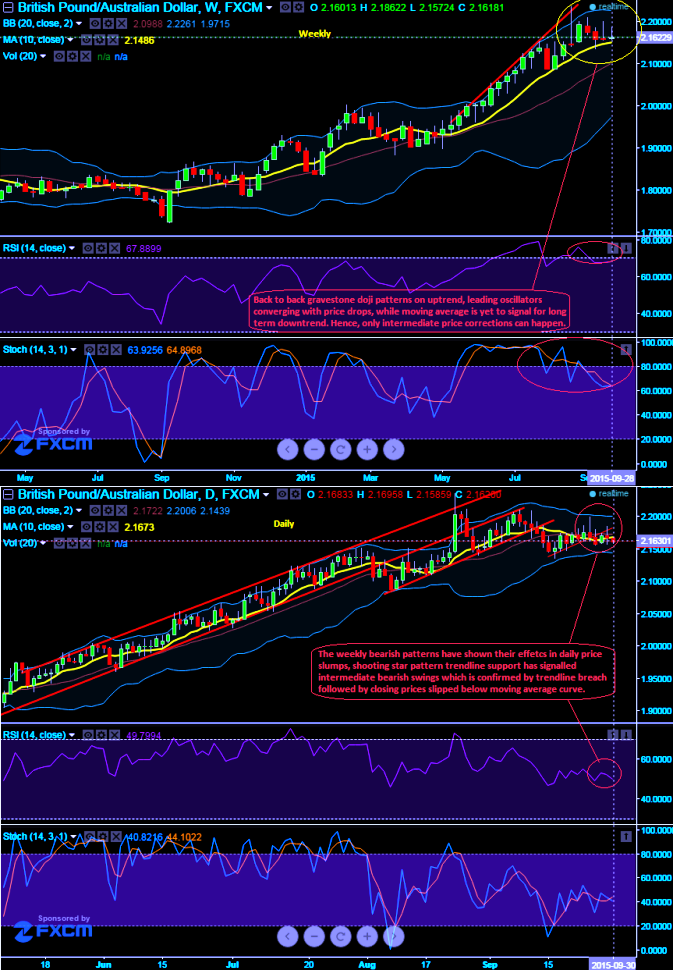

While we were designing long term hedging framework 14 week RSI was used with an objective to track price momentum over medium to long term perspectives. We traced back to back "Gravestone Doji" patterns on these charts at the peaks of uptrend which is now factoring their effects on daily charts. It was found in the last month at 2.1458 levels firstly, we again found the same pattern in last week at 2.1586 levels on a trendline breach.

The strength index curve approached 80 levels (i.e. overbought territory) and it was moving in convergence with dipping prices which signals selling momentum is intensifying. While %D crossover is also signifies the selling pressure at current levels.

Moving onto daily charts, here we again found an intimacy in the trend that suggested by weekly charts as shooting star here again on the trendline support at around 2.1685 levels has factored in daily prices. Current spot FX is ticking at 2.1624 which means almost 60 pips drop from shooting star formation. Overall, we would foresee an intermediate price correction in this pair.

For a swing trader it is all too easy to be carried away by a market that apparently knows no bounds. While slow stochastic on the other hand has neither remained in overbought nor oversold territory and it is signifying slight indecision.

FxWirePro: GBP/AUD weekly doji’s signal bears to take over intermediate trend

Wednesday, September 30, 2015 8:32 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate