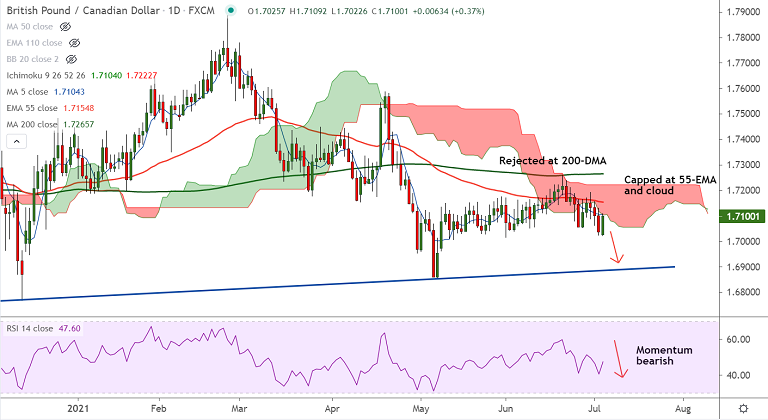

GBP/CAD chart - Trading View

Spot Analysis:

GBP/CAD was trading 0.39% higher on the day at 1.7103 at around 10:20 GMT

Previous Week's High/ Low: 1.7193/ 1.7024

Previous Session's High/ Low: 1.7131/ 1.7024

Fundamental Overview:

UK services sector activity expanded more than expected in June, the final report from IHS Markit confirmed this Monday.

The seasonally adjusted IHS Markit/CIPS UK Services Purchasing Managers’ Index (PMI) was revised higher to 62.4 in June versus 61.7 expected and a 61.7 – last month’s flash reading.

Surge in Crude oil prices are supporting the Canadian dollar. Canada IHS Markit PMI data hits a 4-month low at 56.5 in Jun vs a forecast of 57.4.

Markets eye Bank of Canada business outlook survey scheduled later today for further direction.

Technical Analysis:

- GBP/CAD was extending downside after rejection at 200-DMA

- Minor recovery attempts were capped at daily cloud

- ADX is rising with -ve DMI dominance, supports further weakness

- However, 'Bullish Engulfing' on the daily candle raises scope for upside

- An 'Inverted Hammer' on the previous week's candle, keeps bias bearish

- Price action is below 200-week MA, bearish invalidation only above 200-DMA

Major Support and Resistance Levels:

Support - 1.7048 (Lower BB), 1.6885 (Trendline support), 1.6858 (May 7th low)

Resistance - 1.7121 (21-EMA), 1.7154 (55-EMA), 1.7208 (110-EMA)

Summary: GBP/CAD trades with a bearish bias. However, the potential 'Bullish Engulfing' candle keeps scope for some upside. Daily cloud and 55-EMA offer stiff resistance. Major upside only on decisive break above.